Jan 9, 2023

Biotechs CinCor, Albireo Jump on Takeovers by Larger Drugmakers

, Bloomberg News

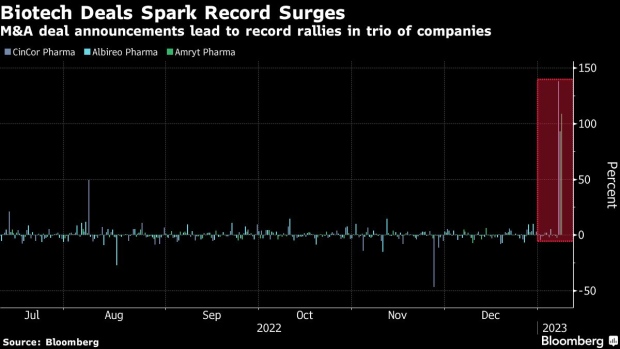

(Bloomberg) -- Multiple small biopharmaceutical companies jumped by a record Monday after larger drugmakers scooped them up, marking a small flurry of activity in the M&A-hungry space as a key sector conference kicks off.

AstraZeneca Plc said it would buy CinCor Pharma Inc. for up to $1.8 billion. CinCor’s shares jumped 144% to make the stock the top performer in the Nasdaq Biotechnology Index. Albireo Pharma, Inc. surged 92%, as the rare disease firm was bought by Ipsen S.A. Also, Amryt Pharma Plc is set to be bought for up to $1.48 billion, sending its American depositary shares up 107%.

The trio of deals, announced as the JPMorgan Healthcare Conference kicks off in San Francisco, only amounts to a few billion dollars in value, potentially underwhelming investors who may have been looking for more of a jolt.

“It’s better than nothing,” Jefferies strategist Will Sevush writes about the CinCor and Albireo deals in a note. But they’re not going to help the space in a “real way,” he says.

All three deals included contingent value rights, which could trigger additional payments to shareholders if certain milestones are met. Investors were assigning partial value to those CVRs in Monday trading, with all three stocks between the basic per-share offer level and the value inclusive of the CVR. As the biotech sector fell 26% last year, the evergreen hope for takeouts in the space has been elevated.

In 2022, the US market saw a total of $138 billion worth of US biotechnology deals, according to Bloomberg data, which is a recovery from the early pandemic levels but still lagging $203 billion worth of transactions seen in 2019 and $186 billion from 2018.

--With assistance from Matt Turner.

(Updates trading to close throughout.)

©2023 Bloomberg L.P.