Dec 10, 2023

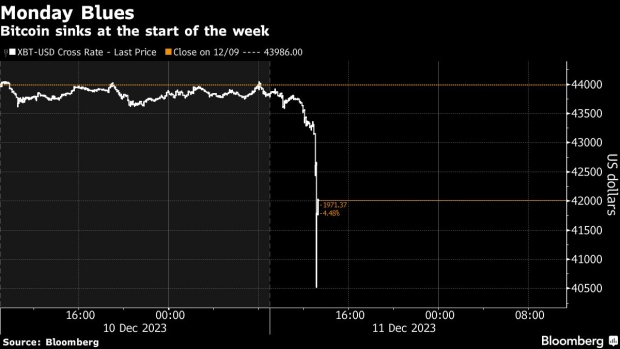

Bitcoin Drops Below $41,000 as Part of a Wider Crypto Selloff

, Bloomberg News

(Bloomberg) -- Bitcoin posted its steepest drop in almost four months as traders moved to lock in profits following a more than 150% rally this year, triggering large liquidations of bullish bets.

The largest token sank as much as 7.7% on Monday, the biggest intraday decline since Aug. 18. It pared some losses to trade 7.5% lower at $40,524 at 2:32 p.m. in New York. Most major cryptocurrencies fell, with an index of the largest 100 digital assets sliding the most since November.

“Market leverage had risen materially,” said Sydney-based Richard Galvin, co-founder of Digital Asset Capital Management. “The current fall looks like a market deleveraging as opposed to any fundamental news catalyst.”

Coinglass data show that about $500 million worth of crypto trading positions betting on higher prices were liquidated on Dec. 11 — the highest tally since at least mid-September.

“This move downward was broadly signaled by large growth in open interest and positive funding rates in perpetual swaps indicating a growth of bullish leverage in the market,” said Darius Tabatabai, co-founder at decentralized exchange Vertex Protocol.

Bitcoin has been on a tear this year on expectations that regulators will give the green light for the first US exchange-traded funds investing directly in the token, widening the potential base of crypto investors. Bets that the Federal Reserve will cut interest rates in 2024 have also helped fuel the rally.

Awaiting the Fed

Investors are braced this week for US inflation data and the Fed’s final policy meeting of 2023, both of which could test aggressive wagers on rate cuts. Global stocks were mixed on Monday as a dollar gauge ticked up, a sign of cautious sentiment.

“It makes sense to see some profit taking,” said Tony Sycamore, a market analyst at IG Australia Pty. He expects falls toward the $37,500 to $40,000 range to be “well-supported” by dip buyers.

Bitcoin has jumped more than 150% year-to-date, energizing a wider recovery in digital-asset prices from a $1.5 trillion rout in 2022. The token remains well below its pandemic-era record of nearly $69,000 set just over two years ago.

A “less hawkish” message from the Fed would likely cause a “re-testing” of Bitcoin’s recent high near $45,000, according to Caroline Mauron, co-founder of Orbit Markets.

--With assistance from Sidhartha Shukla and David Pan.

(Updates prices.)

©2023 Bloomberg L.P.