Dec 6, 2023

Bitcoin’s Rally Burns $6 Billion for Short Sellers

, Bloomberg News

(Bloomberg) -- Bitcoin’s blistering rally in 2023 has made betting against cryptocurrency company stocks a losing bet for short sellers.

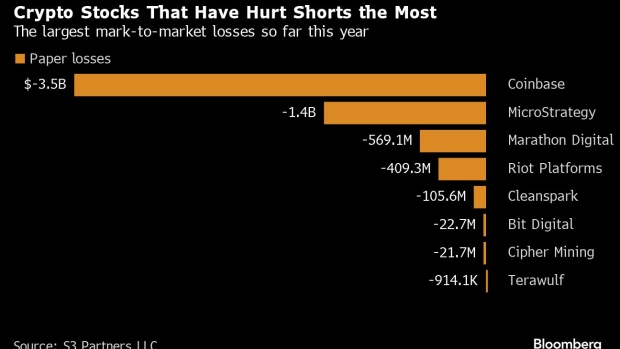

Traders betting on declines in crypto-related companies such as Coinbase Global Inc., MicroStrategy Inc. and Marathon Digital Holdings Inc. have accumulated paper losses of $6 billion so far this year, according to data from S3 Partners LLC.

Bitcoin’s more than 165% jump is driving the gains in crypto stocks, which are highly linked to the price of the digital asset. Hopes of further regulatory clarity and that a US-listed Bitcoin exchange traded fund is on the horizon have also lifted the sector this year. But that optimism has increased chances of a short squeeze, when gains force short sellers to buy back the stocks they’ve bet against to exit losing positions, lifting shares further.

Read more: What Is Bitcoin ‘Halving’? Does It Push Up the Price?: QuickTake

“Buying-to-cover in the most shorted crypto stocks such as Coinbase Global, MicroStrategy, Marathon Digital Holdings and Riot Platforms will help push stock prices higher along with the long buying that has driven up stock prices since the end of October,” Ihor Dusaniwsky, managing director of predictive analytics at S3, said in a Dec. 5 report.

Coinbase has contributed the most pain to short sellers betting against the sector this year. The company’s 290% rally has amounted to about $3.5 billion in losses, more than half of the total shed so far in 2023. MicroStrategy, which is up more than 300% this year, has added $1.4 billion to crypto short’s losses this year.

Read more: Coinbase Stock Triples in 2023 After Firm Survives Crypto Chaos

Of course, even as losses mount for short sellers, some continue to put more money into the contrarian trades, betting the rally will soon run out of steam. Since mid-September, when Bitcoin bounced back from a string of losses, there’s been nearly $700 million of new short selling, according to S3.

But that’s likely to reverse if Bitcoin continues to grind higher and lift shares of crypto stocks, adding to the roughly $2.2 billion of short covering seen in the sector so far this year.

“Investors looking for crypto exposure can now pick between the actual cryptocurrencies or crypto stocks,” Dusaniwsky said. “If the recent momentum continues, both look to outperform the market.”

©2023 Bloomberg L.P.