Nov 15, 2023

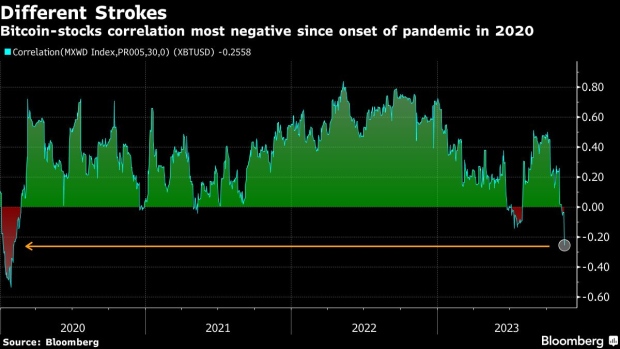

Bitcoin-Stocks Correlation Now Most Negative Since Covid’s Onset

, Bloomberg News

(Bloomberg) -- The buy-everything wave that just swept across global markets has bypassed Bitcoin, which is down since a soft US inflation print rolled across trading screens and stirred a bout of wider risk taking.

The drop since the US data were published on Tuesday morning compares with a 2% jump in an index of global shares on bets that the Federal Reserve is done with interest-rate hikes and will pivot to cuts next year.

A 30-day correlation coefficient for Bitcoin and MSCI Inc.’s gauge of world stocks now sits at minus 0.23, the most negative since the onset of the pandemic in early 2020. A reading of 1 indicates assets are moving in lockstep, while minus-1 would show they’re moving in opposite directions.

Ordinarily, tumbling bond yields, surging equities and expectations of a Fed reversal would be viewed as the kind of backdrop that augurs well for crypto too, given that digital tokens are emblematic of speculative zeal.

But Bitcoin had already doubled in 2023 partly on optimism that regulators will allow the first US exchange-traded funds investing directly in the token. Those gains stoked some caution about how much further Bitcoin can advance.

“Ahead of the expected ETF announcement, the market has had a good rally, and perhaps last night’s selloff was weak hands folding given a lack of continued upside progress over the past week,” said Tony Sycamore, a market analyst at IG Australia Pty.

Sycamore also said that the closer Bitcoin is to the $38,000-$40,000 level, the bigger the chance of a “‘buy-the-rumor-sell-the-fact-type’ reaction” as and when the ETFs get the green light.

Bitcoin, which hit a record high of almost $69,000 in late 2021, was trading at about $36,275 as of 10:44 a.m. in New York on Wednesday. Second-ranked token Ether edged back above $2,000.

--With assistance from Akshay Chinchalkar.

©2023 Bloomberg L.P.