Jan 3, 2023

BOJ Boosts Bond Buying for Fourth Day to Cap Rise in Yields

, Bloomberg News

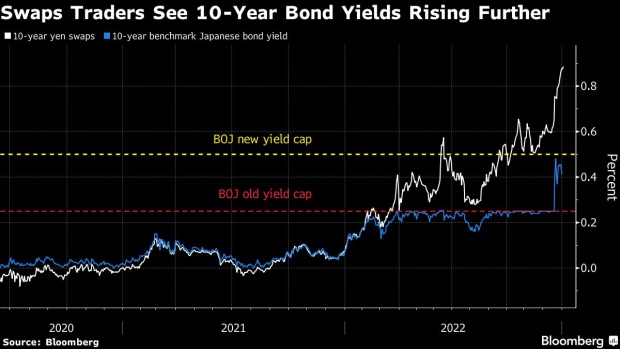

(Bloomberg) -- The Bank of Japan’s decision to double its 10-year yield ceiling was meant to improve market functioning. So far it’s triggered even heavier intervention from the central bank, threatening to reduce liquidity further in the local bond market.

The BOJ announced a fourth day of unscheduled bond buying Wednesday, offering to buy unlimited amounts of two- and five-year notes and to purchase ¥600 billion ($4.6 billion) of 1-to-25 year bonds. The announcement came in addition to its outstanding daily offer to buy unlimited quantities of 10-year securities and those linked to futures at 0.5%, the new cap for benchmark yields.

Wednesday’s move came despite a strong start to the year in global bond markets with Treasuries surging and German bunds rallying on signs of slowing inflation. But the purchases failed to stop the selloff in Japan’s benchmark bond with yields closing 4 basis points higher at 0.45% amid concern that Thursday’s auction of a new 10-year note will see weak investor demand.

December’s yield-curve shift has spurred more bets from traders the BOJ will lift its cap further or scrap it altogether as inflation picks up in Japan. That sparked a selloff in debt, requiring even more bond purchases from the central bank to keep yields in check.

The BOJ conducted similar purchase operations between Dec. 28 and 30, buying a total of ¥2.3 trillion of bonds.

“The BOJ is showing an abundance of caution as bets on higher JGB yields might have become too one-sided,” said Eugene Leow, a fixed income strategist at DBS Bank Ltd. in Singapore. I would “focus on the bigger consumer-price inflation picture and further potential yield-curve control shifts in the coming months.”

BOJ Governor Haruhiko Kuroda reiterated on Wednesday that the bank will continue with monetary easing in order to achieve its sustainable price target, speaking at a financial industry event.

The yen lost ground in US trading Wednesday, weakening around 0.4% to 131.48 per dollar, reversing an earlier gain that took it to as strong as 129.93 per greenback.

Thursday Auction

Thursday’s benchmark bond sale may fetch a yield a little higher than 0.5%, Keisuke Tsuruta, a bond strategist at Mitsubishi UFJ Morgan Stanley Securities Co. in Tokyo., wrote in a note. Because the yield is kept lower than the 0.5% ceiling, 10-year notes look overvalued relative to other tenors and swaps, he said.

For Steven Major, head of fixed income research at HSBC Holdings Plc., the BOJ’s tweak to yield curve control in December wasn’t necessarily the start of a hawkish pivot, thanks in part to the risk of a global recession including in Japan. It was more of a “curve ball” for technical factors specific to the local bond market.

“This was a technical adjustment to buy more time,” he said on Bloomberg Television on Wednesday. “The turning point kind of came in October when we got to the peak for dollar-yen and the maximum steepness for the long end of the Japanese curve and the realization that there’s no bonds left to buy.”

--With assistance from Ruth Carson, David Ingles and Emi Urabe.

(Updates pricing to add yen move.)

©2023 Bloomberg L.P.