Aug 5, 2020

Bonds beat stocks in Canada with US$2.8B in July ETF flows

, Bloomberg News

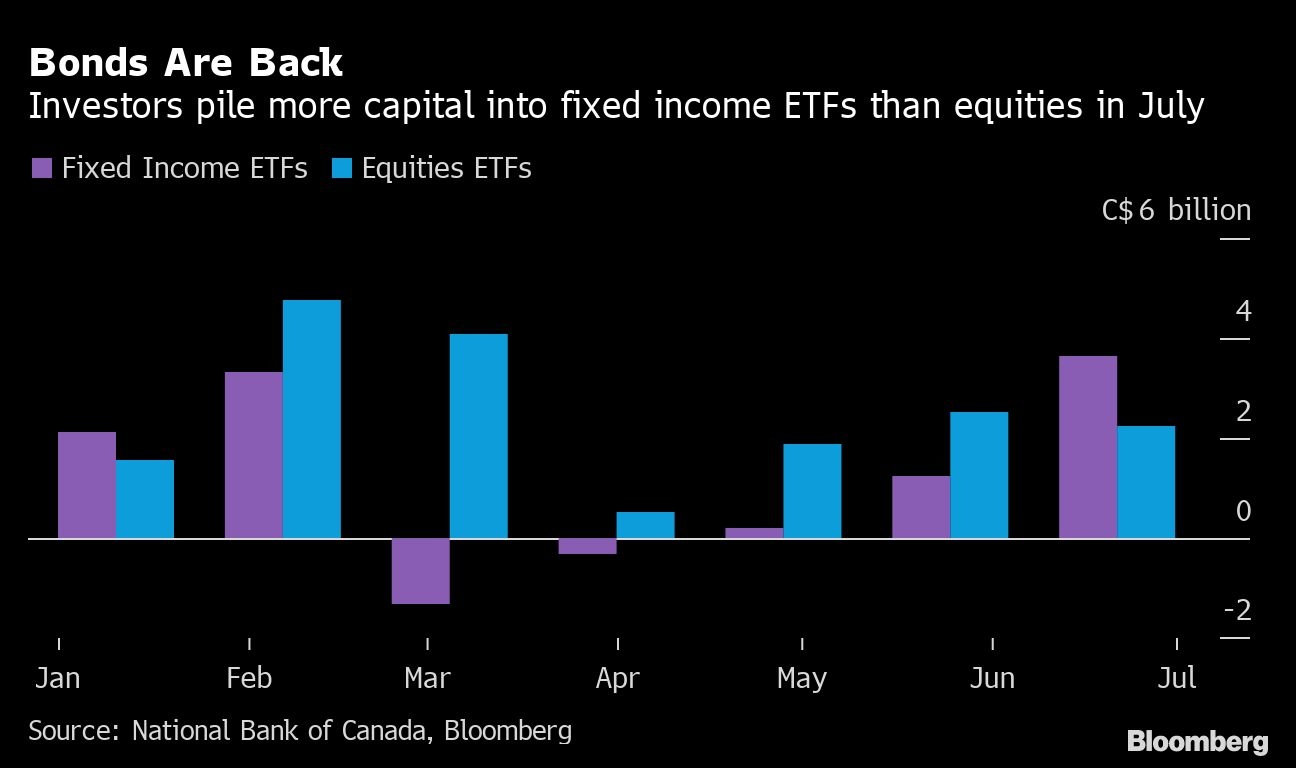

Bonds are back in vogue for buyers of Canadian exchange-traded funds.

After months of lagging behind their equity counterparts, fixed-income ETFs attracted net capital of $3.7 billion (US$2.8 billion) in July, their highest month of inflows this year, according to data from National Bank of Canada. That made up more than half of the $6.2 billion received last month by ETFs, which was the most since February.

It was the first month this year that fixed-income ETFs outsold equity funds.

About 43 per cent, or $1.6 billion, of bond ETF inflows went to one fund -- NBI Unconstrained Fixed Income ETF -- thanks to one large institutional-size block subscription toward the end of July, Daniel Straus, vice president of ETFs and financial products research at National Bank, said in a report.

This actively-managed fund consists mainly of global bonds, with Australian, Indonesian, Russian and Italian government bonds among its top holdings as of June 30. About 25 per cent of the portfolio was investment-grade corporate debt and 14 per cent is high-yield corporate.

Canada aggregate bond ETFs like BMO Aggregate Bond Index ETF and TD Canada Aggregate Bond Index and the popular cash ETFs made up most of the remaining fixed-income new sales.

Still, risk appetite in stocks has remained strong over the past three months as equity ETFs saw an influx of $2.2 billion in July, with technology and materials funds welcoming the highest inflows, Straus said. The materials group includes some ETFs with gold-mining stocks.

Commodities funds attracted $119 million in capital last month, with single long gold ETFs accounting for 90 per cent of those inflows.