Sep 19, 2023

Brunswick Prep School Is Borrowing to Expand Campus and Housing

, Bloomberg News

(Bloomberg) -- An elite boys’ prep school located in hedge-fund capital Greenwich, Connecticut, is borrowing money to finance expansion and faculty housing.

The Connecticut Health and Educational Facilities Authority plans to sell $28 million in revenue bonds next week for the Brunswick School, which will use the proceeds to buy the 16.5-acre campus originally built for Rosemary Hall, a boarding school that opened in 1903. The acquisition will enable Brunswick to “expand its early childhood education offerings and its employee housing options,” according to preliminary bond offering documents.

Prep schools rarely borrow in the municipal bond market, but that may change as demand for the institutions, with their enhanced access to the Ivy League and other top colleges and universities rises. The new bond deal will enable the school to add up to 35 new students to its Middle School and Upper School divisions, the documents say.

It will also allow Brunswick to move its Pre School, with enrollment of 90 boys, to the new campus in fall 2024 and create a daycare for up to 50 infants to preschool-aged children.

Elite boarding and day schools have no taxing power, and rely on tuition and fees, endowment earnings, and funds from alumni to pay the bills. Brunswick alumni include social network pioneers and OG Bitcoiners, Cameron and Tyler Winklevoss, and retailer Vineyard Vines founders Ian and Shep Murray.

Last September, Brunswick launched a campaign to raise $130 million and as of Sept. 15 over 51% of that goal has been met, the documents say. Its previous campaign, launched in 2012, raised $106.7 million, topping its $100 million goal. In the investor roadshow for the upcoming bond sale, the school says its endowment reached a market value of $179 million as of June 30, 2023.

The school didn’t respond to requests for comment.

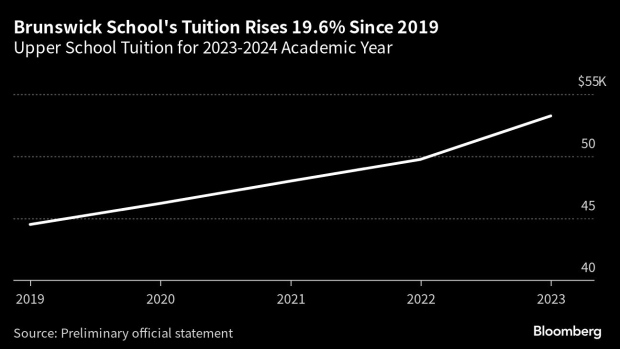

Brunswick runs from Pre-Kindergarten through Grade 12. Annual tuition for the current academic year ranges from $45,225 for Pre-K to $53,250 for the Upper School, Grades 9 through 12. The average annual tuition increase over the past five years has been about 3.5%, according to the roadshow document. Brunswick says that 25 of the 108 graduates of the Class of 2023, or 23%, will attend an Ivy League school.

For the current academic year, Brunswick’s acceptance ratio was 26%. This is down from 30% in 2022, but up from the 21% notched in the pandemic year of 2020, when the school experienced a surge in applications to 792, “a significant portion of which came from New York City-based families,” according to the documents.

Greenwich sold bonds earlier this year, and in its bond offering documents noted that the value of owner-occupied housing units in the town had a median value of $1.38 million, compared to $433,000 in Fairfield County and $279,700 in the state of Connecticut.

Brunswick says that of the 174 full-time and six part-time faculty it employs, 85 live in school-owned housing near its campus. The renovation of up to four buildings on the newly-acquired campus will provide 16 units of employee housing, and “will enable many resident faculty members to walk from home to their classrooms.”

S&P Global Ratings graded the latest bond deal A+, citing “the school’s solid market demand and position amidst the backdrop of the competitive school environment in the Northeast.”

The underwriter of the bonds, JPMorgan Chase & Co., said it couldn’t comment before or during the pricing of the issue. Bonds are scheduled to price on Sept. 26.

©2023 Bloomberg L.P.