Jul 14, 2023

Canadian real estate agents slash their sales outlook as gains slow

, Bloomberg News

The industry group for Canada’s real estate brokers cut its forecast for home sales as tight inventory and the Bank of Canada’s recent rate hikes weigh on the housing market.

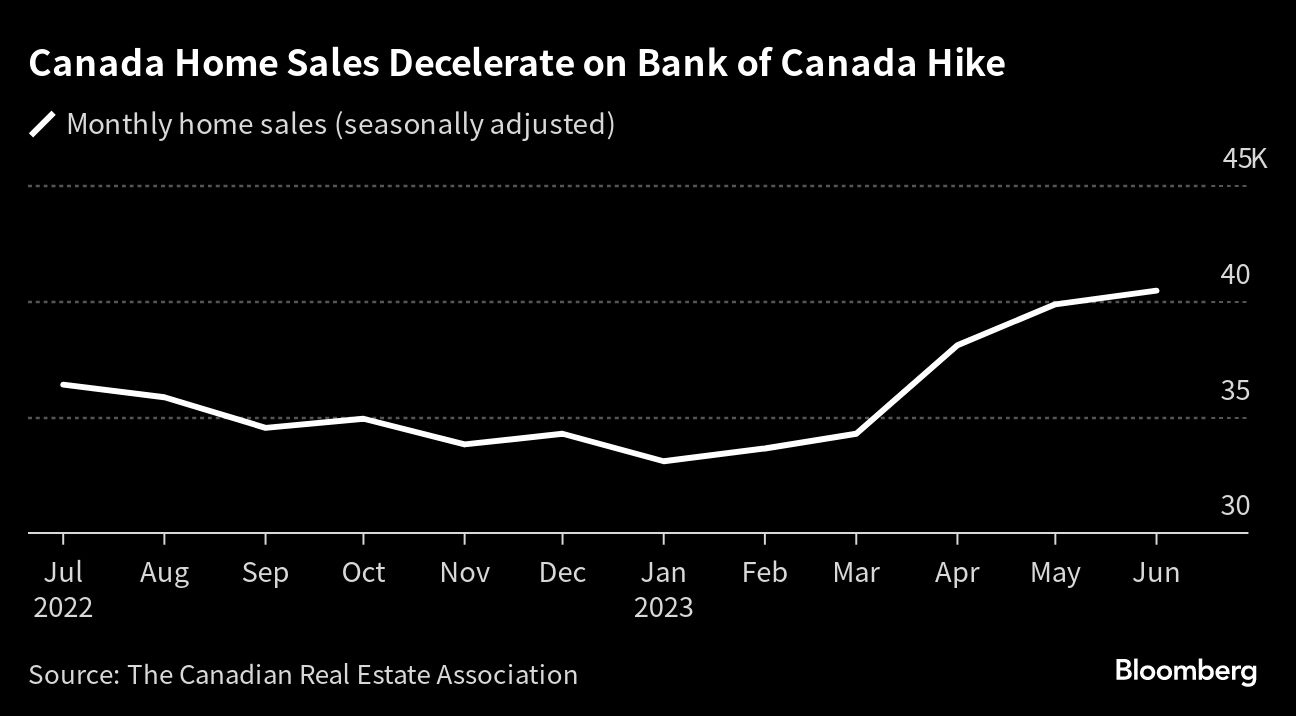

The Canadian Real Estate Association now estimates that sales in 2023 will be down 6.8 per cent from a year earlier, a more drastic decline than the 1.1 per cent decrease expected in an April forecast. Sales started to come under pressure in June with the number of transactions up just 1.5 per cent from May, smaller than the increases in April and May, according to seasonally adjusted data released Friday.

Homebuyers are contending with the prospects of even tighter economic conditions. The Bank of Canada raised its benchmark rate for a second straight meeting in July and left open the potential for more increases ahead.

Recent rallies in home transactions had already been losing steam and took a hit from the resumption of rate hikes, the real estate group said.

“With the Bank of Canada unexpectedly ending its pause on rate hikes in June and hiking again in July, a major source of uncertainty has returned to the housing market,” the CREA said in a statement.

Housing prices have climbed higher in recent months, in part because of a lack of homes for sale. The benchmark price for a house in the country climbed two per cent in June from a month earlier to $749,100 (US$570,526).

While total active listings jumped in most major Canadian cities last month, the number of listed homes remains historically low. There were just 3.1 months of inventory nationally at the end of June, down more than a full month from the most recent peak at January’s end and below a long-term average.

The CREA cautioned that some buyers might move back to the sidelines as many did in 2022 to wait for additional signals from the Bank of Canada. The real estate group said its sales outlook reflects a view that transactions will “stabilize or rise at a slower pace than they have in recent months.”

“Raising rates does not fix the supply problem we have in housing,” Jim Thorne, chief market strategist at Wellington-Altus Private Wealth, said this week on BNN Bloomberg Television.

A population boom is exacerbating the supply crunch. Canada’s population rose 0.7 per cent in the first three months of the year, the highest rate of growth for a first quarter in data going back a little more than 50 years, according to Statistics Canada.

If the central bank changes course, pausing hikes or cutting rates, that could provide some stability the housing market needs to take off again, according to condominium developer Barry Fenton.

“When you look at the Canadian market in the last year, we’re down 10 per cent,” said Fenton, president of Lanterra Developments. “But once we stop the interest rate increases, or at least people think there’s certainty, we’re going to be way on fire.”