Mar 11, 2022

Cannabis Canada Weekly: Feds propose new pot drink rules, Alberta green-light's consumption spaces

Federal government to amend pot drink regulations

Feds propose long-awaited changes to pot drink regulations

Canadians could soon be able to buy more cannabis drinks at their local pot shop after the federal government proposed new regulations that would loosen restrictions that limit the number of infused beverages a consumer can purchase.

The Canada Gazette published new regulations on Friday aimed at amending the Cannabis Act, which would allow consumers to buy as many as four dozen 355-millilitre infused drinks at a time, by changing the equivalency ratio of dried cannabis included in a liquid. This would be a sharp increase from the five-can maximum that consumers are to allowed purchase at a time. The Gazette will give 45 days for the public to weigh in on the proposed changes before amending the regulations.

"Amendments to Schedule 3 to the [Cannabis] Act would increase the public possession limit for cannabis beverages, which would correct an unintended consequence of the current equivalency, which restricts the possession and sale of beverages to a greater extent than other forms of cannabis," the Gazette said.

"The proposal would seek to increase the limit on cannabis beverages to be more in line with the limits that exist for other forms of cannabis."

Cannabis companies like Hexo Corp, which has a beverage joint venture with Molson Coors Beverage Co., and Canopy Growth Corp. have invested heavily in bottling facilities and cannabis-infused beverage research and have long demanded changes to regulations to allow the sale of more drinks.

The category is relatively novel for long-time cannabis users but is widely seen as a way to turn so-called "canna-curious" people into pot consumers.

"While the public possession limit applies to and therefore affects the purchase of all cannabis products, data on consumer spending habits and retail prices of cannabis beverages illustrates that cannabis beverages face greater restrictions," the Gazette said.

"For cannabis beverages, consumers can only purchase five 355 mL cans per transaction, which have an average market value of $30, a value that is well below typical consumer spending habits."

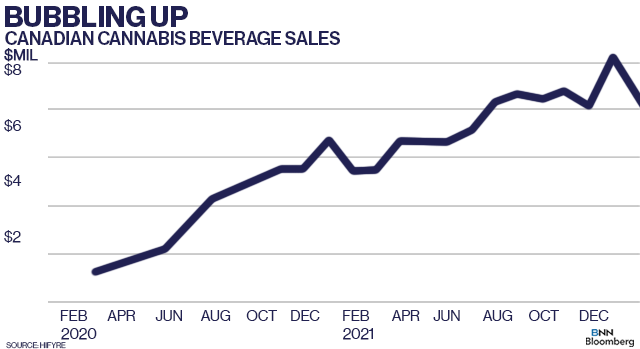

The beverage segment generates roughly $7 million to $8 million in monthly sales in Canada and represents roughly two per cent of all cannabis sales, according to data provider Hifyre. That lack of return on investment has raised questions among industry analysts as to why companies are spending millions of dollars entering a product category that has yet to gain a strong foothold amongst fickle consumers.

TOP NEWS OF THE WEEK

Alberta green-lights cannabis consumption spaces for private events

The first Canadian cannabis consumption spaces are set to come later this year after Alberta's cannabis regulators gave the green light for retailers to deliver purchases. That would also allow licensed retailers to "ship" cannabis edibles including drinks to customers during private events in designated areas, the Calgary Herald reported. The newspaper reported the model will see festivals and live events offer fans a designated consumption area where products can be delivered and consumed with food or beverages. As well, alcohol will not be allowed to be sold or combined with cannabis products, the Herald reported. While no festival has officially announced plans to offer a designated space, it is a small, yet significant leap forward after more than three years of legalization and a dearth of licensed consumption spaces across the country.

U.S.'s SAFE Banking legislation remains in purgatory despite widespread support

The future of the U.S.'s SAFE Banking Act, a piece of legislation aimed at allowing federally-regulated banks or other financial institutions to conduct business with cannabis operators, remains murky despite ongoing efforts to get it passed. Marijuana Moment reports that Colorado Rep. Ed Perlmutter continues to place pressure on his Senate colleagues to get the measure passed, pledging to be a "real pest" until it's done. Meanwhile, a new poll released by the American Bankers Association (ABA) found that nearly two-thirds of Americans support the passage of a SAFE Banking-like bill. "Consumers clearly agree that now is the time to resolve the ongoing conflict between state and federal law so banks can serve legal cannabis and cannabis-related businesses," according to ABA Chief Executive Officer Rob Nichols in a release.

Acreage Holdings Q4 sales jump 58% while incurring steep impairment charge

Acreage Holdings, the U.S. cannabis operator that Canopy Growth will acquire the moment the U.S. legalizes cannabis, reported fourth-quarter results earlier this week. The company said its fourth-quarter revenue jumped 58 per cent to US$58.1 million, while seeing adjusted EBITDA of US$8.5 million. The company still posted a net loss of US$40.4 million. It attributed the loss to "depreciation and amortization expenses and interest charges," while incurring a US$31.4-million impairment charge on its income statement. Canaccord Genuity's Matt Bottomley said in a note that the results were below the firm's expectations during a period where cannabis sales in the U.S. faced "macro-level headwinds". Canaccord maintains a speculative buy on Acreage with a US$5-per-share target price over the next 12-months.

Israel decriminalizes cannabis while recreational sales remain outstanding

Israel's justice minister signed new regulations on Wednesday that would simply fine those found in possession of cannabis for personal consumption - a move that effectively decriminalizes marijuana in the country, Leafly reported. Israel, which already legalized medical cannabis, came days after the country's president announced plans to facilitate expungement efforts for past offenders. It also could usher in new regulations that would legalize recreational use of the drug after prior attempts failed as recently as Nov. 2020.

ANALYST NOTE OF THE WEEK

VILLAGE FARMS' EUROPEAN AMBITIONS

Village Farms International's Pure Sunfarms cannabis subsidiary became the latest pot company to receive EU-GMP certification for one of its production facilities. The announcement will allow Pure Sunfarms to ship some of its Canadian-grown cannabis to Europe's burgeoning medical market, which includes Germany. Alliance Global Partners Analyst Aaron Grey said in a note to clients that the announcement falls in line with Pure Sunfarms' strategy of being a "second-mover" in certain cannabis markets, pointing out that the company launched in Canada one year after legalization took place and controls the country's top flower brand. "While we see opportunity for Village Farms in Germany as a second-mover, we caution on the magnitude of revenue contributions near-term given the German medical market has seen stalled growth the past few quarters and other companies have been citing intensified competition," Grey said. He's maintaining a buy rating on the company's stock with a $17-per-share price target, implying a 286 per cent return.

Meanwhile, Raymond James' Rahul Sarugaser disputed claims that Village Farms will turn unprofitable due to inflationary pressures, and cited the company's ability to grow cannabis at cost-effective prices as a "strategic and tactical pricing lever" that it can leverage as needed. "While Village Farms's peers burn cash operating with negative margins in the pursuit of market share, we believe Village Farms's is biding its time, ready to pounce as peers sputter," Sarugaser said in a note. Raymond James maintained its strong buy on Village Farms, while describing the company as "bar none, the best operator in the Canadian cannabis sector."

CANNABIS SPOT PRICE

$5.13 per gram

-- This week's price is up one per cent from the prior week, according to the Cannabis Benchmark’s Canada Cannabis Spot Index. This equates to US$1,836 per pound at current exchange rates.

WEEKLY BUZZ

"We’ve decided that the folks who have been most impacted actually have the space and the real runway to participate in a meaningful way."

- Chris Alexander, New York's executive director of the state's Office of Cannabis Management, on why they are giving New Yorkers who have been convicted of marijuana-related offences first dibs on applying for retail licences.