Oct 16, 2021

Cannabis Canada Weekly: Government review aims to shape next chapter of legalization

Three years post-legalization, Canada's cannabis industry ready for a reset

Three years after Canada legalized cannabis, the industry appears ready for a reset.

When midnight struck on Oct. 17, 2018, Canada became the first developed nation to allow the sale of cannabis for recreational purposes, and since then the industry has had its share of ups and downs. While billions of dollars worth of legal pot has been sold across thousands of licensed stores, helping to stamp out roughly half of the illicit market, it's also seen many cannabis companies cumulatively post billions of dollars in losses as market dynamics warped lofty expectations made in the early days of legalization.

But change may be afoot as the Canadian government undertakes a lengthy 18-month-long review of the legislation that legalized cannabis, which many in the industry hope will address several shortcomings and stabilize some of the more tenuous parts of the sector, like lowering fees or amending packaging and potency requirements.

"What's at stake is that three years from now, we don't all look back with a tragic collective sigh about the unrealized opportunity," said George Smitherman, president of the Cannabis Council of Canada, the industry's main lobby group. "The risk is that we'll have run out of energy for the kind of continuous quality improvement that a brand new out-of-the-box law like this needs."

The legislation states that the Minister of Health, the ministry that is tasked with regulating cannabis in Canada, will review how legalization has impacted public health, notably among youth as well as the impact it has had on Indigenous persons and communities and home cultivation. A spokesperson for Health Minister Patty Hajdu told BNN Bloomberg that further detail on the review will come soon.

"As with any new legislation, especially for something as comprehensive as the Cannabis Act, there will always be room for improvement and adjustments to ensure it is meeting its objectives: keeping cannabis out of the hands of youth while keeping profits out of the hands of criminals and organized crime," said Andrew MacKendrick, spokesperson for the Health Minister.

"STILL A BLOODBATH"

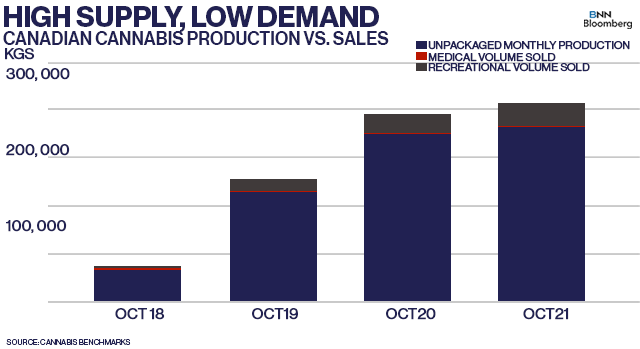

At 776 producers, the amount of companies licensed to sell or process cannabis in Canada has reached a staggeringly high figure that many industry observers and analysts alike believe contributed to the oversupply of legal pot in the market.

As a result, it led to billions of dollars of writedowns and millions of grams of unsold marijuana being disposed of. While that figure may also demonstrate a successful transition for those moving from the illicit to the legal market, some people see the current state of the industry as unsustainable and leading to heavy consolidation.

"It's highly inefficient, but they have the right to exist and I think good business practices will prevail," said Mandesh Dosanjh, chief executive officer at Pure Sunfarms, the wholly-owned cannabis subsidiary of Village Farms International Inc. "We're seeing some very interesting things from (licensed producers), dropping pricing to the point where they're losing money, quarter after quarter, negative margins, and just not making any money to their bottom line. It's a bit of a bloodbath out there for some licensed producers."

To continue reading the full article, click here

THIS WEEK'S TOP STORIES

Dutchie raises US$350M in latest financing round, valued at US$3.75B

Cannabis technology company Dutchie raised US$350 million in new funding, valuing the firm at US$3.75 billion. The financing was led by D1 Capital Partners and included other venture capitalists such as Tiger Global, DFJ Growth and Snoop Dogg's Casa Verde Capital. The company plans to use the proceeds to further expand its employee base and develop more fintech tools for the cannabis industry, said Dutchie Chief Executive Officer Ross Lipson in an interview with BNN Bloomberg. "We want to make sure that we have an optimized experience for the consumer, so they can pay in-store and that's integrated into the point-of-sale," Lipson said. "But then there's further things like rewards, loyalty, and the potential to do lending and help with capital for dispensaries." It also aims to expand internationally outside its base of North America, he added. "We want to be in a position where we're there as soon as new markets open up," Lipson said.

M&A Wrap: Canopy buys Wana option, Cresco Labs expands in Pennsylvania

Canopy Growth is paying US$297.5 million for the option to acquire Colorado-based cannabis edibles brand Wana in a move that should (eventually) boost the pot giant's presence in the fast-moving market segment. Canopy will be able to acquire Wana - and the three entities that co-own the brand - once the U.S. makes cannabis "federally permissible". When that happens, Canopy will have to pay 15 per cent of the fair value of each entity with cash, stock, or a mix of the two. Meanwhile, Chicago-based Cresco Labs is moving into Pennsylvania with a deal to buy medical operator Laurel Harvest Labs for US$80 million. Once the deal closes, Cresco will have access to Laurel's production facility and its small retail presence in the state. Lastly, PharmaCann said it will acquire Colorado-based LivWell Holdings for an undisclosed sum.

Drake joins Bullrider as new investor, advisor in latest cannabis venture

Drake is getting back into the pot game. The Toronto-based artist and entrepreneur, whose real name is Aubrey Graham, is joining cannabis brand Bullrider and its parent company Robes Inc. as an investor, partner and special advisor, according to a statement on Friday. The size of Drake's investment in Robes wasn't disclosed. Drake joins OVO co-founder and producer Noah "40" Shebib in the venture, which has released a handful of strains into the Canadian recreational market. According to Hifyre, sales of Bullrider were about $1.9 billion in the first nine months of the year. Drake previously worked with Canopy Growth to launch his own More Life cannabis brand back in 2019, but the two formally parted ways earlier this year.

B.C. retailer group pens open letter amid proliferating illicit market

The ongoing proliferation of the illicit market in British Columbia has made some of the province's retailers demand the resignation of Mike Farnworth, B.C.'s Minister of Public Safety and Solicitor General Mike Farnworth, The Oz reports. The Okanagan Cannabis Collective, which represents approximately 20 cannabis stores, issued an open letter stating that Farnworth is "incapable of managing" the legal regulated cannabis market in B.C.. The group pointed to a Google Maps link that showed 35 illicit cannabis stores operating in the province without a licence. In addition to demanding Farnworth's dismissal, the group is lobbying to get rid of wholesale markups, annual licensing fees and a 20 per cent tax on vape products.

U.S. senators urge AG Garland to deschedule cannabis

If legislation can't legalize cannabis, maybe the U.S. Justice Department will. That's what U.S. Senators Elizabeth Warren and Cory Booker are trying to do after sending the Justice Department a letter requesting that it deschedules cannabis to help U.S. states regulate the substance "as they see fit", reports Marijuana Moment. “We urge the DOJ to initiate the process to decriminalize cannabis,” the senators wrote. The industry news site said that the senators may be appealing to Attorney General Merrick Garland to initiate a process that could see him change cannabis policy without Congress's approval. Another method could involve a scientific review by the U.S. Department of Health and Human Services which could see the Food and Drug Administration take an outsized role in regulating cannabis federally. The senators said the Attorney General should respond to their letter by Oct. 20.

Quarterly Results Wrap: Avant Brands, Valens

Here's a summary of some of the cannabis industry companies that reported quarterly results this week:

- Avant Brands: Third-quarter revenue up 32 per cent to $2.7 million, $267,000 in an adjusted EBITDA loss, compared to a $560,000 gain a year earlier. (Release)

- Valens Co.: Third-quarter revenue up 32.7 per cent to $24.6 million, $6.2 million in an adjusted EBITDA loss, compared to a $1.4 million gain a year earlier. (Release)

ANALYST NOTE OF THE WEEK - Stifel, Raymond James on the Canopy-Wana deal

Stifel Analyst Andrew Carter didn't appear to be impressed with Canopy Growth's deal to (eventually) acquire gummy maker Wana on Thursday. In a note to clients, he stated that the deal is likely to push Canopy into a net debt position while the fact that full terms weren't disclosed makes valuing the agreement difficult to gauge. He notes that U.S. producers that license the Wana brand may now look to de-emphasize their ties to its products knowing that Canopy will eventually take the business over. However, Raymond James' Rahul Sarugaser offers a different take, stating that Wana's Canadian partner - Indiva Ltd. - may now be in play to be acquired by Canopy sometime soon. Sarugaser gives it a 66 per cent chance of it happening as it might be more cost effective to acquire Indiva than to pay a termination fee to end its licence agreement with the brand once it buys Wana. He does give it a one per cent chance that Canopy and Indiva "don't play nice" and don't come to an agreement regarding the Wana brand in Canada.

CANNABIS SPOT PRICE: $5.10 per gram -- This week's price is down 0.3 per cent from the prior week, according to the Cannabis Benchmark’s Canada Cannabis Spot Index. This equates to US$1,859 per pound at current exchange rates.

WEEKLY BUZZ:

$1.068 billion

- The amount of federal and provincial taxes derived from cannabis sales since it was legalized in 2018, according to Statistics Canada.