Jan 25, 2022

Chewy, Freshpet Lose Luster as Pandemic Trade Keeps Fading

, Bloomberg News

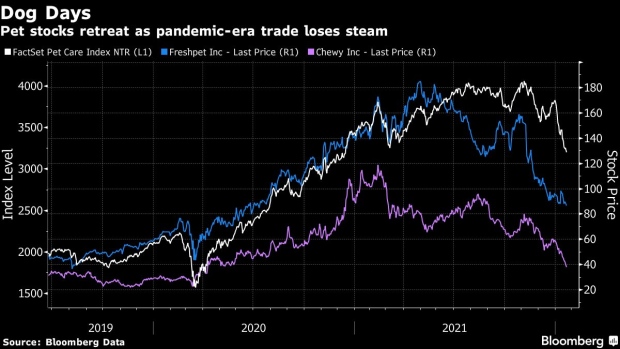

(Bloomberg) -- The ranks of pandemic winners-turned-losers have swelled with another corner of the market: pet product suppliers.

Chewy Inc. and Freshpet Inc., darlings of the stay-at-home era when more people brought animals into their homes, have seen their share prices plummet by more than half from last year’s records, reaching their lowest levels since 2020 this month as the growth outlook slows and investors shun riskier assets amid expectations of Federal Reserve policy tightening.

After Freshpet cut its 2021 sales guidance earlier this month, Truist lowered its estimate for 2022, citing headwinds for companies in the group from supply chain, labor and input costs. Piper Sandler downgraded Chewy to neutral this month with headwinds seen for both sales and margins.

These stocks are part of a growing list of high-fliers that thrived during lockdowns and are coming back to earth. Netflix Inc. and Peloton Interactive Inc., two high-profile stars of the pandemic era, have plunged to near pre-crisis levels amid disappointing results. Zoom Video Communications Inc., the owner of the ubiquitous videoconferencing software, is trading near the lowest level since May 2020.

Chewy and Freshpet aren’t the only pet stocks subject to the return to normal. PetMed Express Inc. sank to a March 2020 low on Monday just before the pet pharmaceutical company reported sales declined from a year earlier. PetMed Chief Financial Officer Bruce Rosenbloom attributed the “disappointing” numbers to several factors, among them pet owners being able to go back to vet offices in person, as opposed to using PetMed’s online services since pandemic-era shutdowns have been lifted.

While stocks have tumbled, bearish bets on pet stocks are close to the highest levels of the past year, with short interest near 25% of float for Chewy, almost double the level of a year ago, according to S3 Partners data. It’s up threefold to more than 6% for Freshpet and remains close to the past year’s highs for PetMed at 25%, the data show.

Despite downgrades and investor pessimism, analysts generally remain bullish on the stocks. Chewy has 15 buy recommendations among 24 analysts surveyed, while FreshPet rates 12 buys out of 15 total. PetMed is more nuanced with 2 buys, 1 hold and 1 sell. While lowering his estimates, Truist analyst Bill Chappell ranks among those positive on FreshPet’s stock.

“We continue to believe this is a unique, wide-moat, growth story and that issues disrupting near term results are transitory,” he said. “That said, we understand it will take at least a few months for the story to regain investor confidence.”

©2022 Bloomberg L.P.