Apr 24, 2022

China Covid Shock Sees Beijing Consider Risky Debt Option Again

, Bloomberg News

(Bloomberg) -- China has signaled a willingness to allow local governments to increase off-balance sheet debt again after a crackdown in recent years to bring it under control.

The People’s Bank of China said last week that banks should meet the “reasonable funding needs” of local government financing vehicles, or LGFVs, and not “blindly” suspend or withdraw loans from the companies. The measures were one of 23 listed by the central bank to help boost lending and support industries battered by Covid outbreaks and lockdowns.

While Beijing still remains committed to debt control, the economy’s slump is forcing policy makers to ease up on some restrictions. To bolster growth, local governments have been instructed to boost investment in infrastructure, but since they face a cash crunch because of a property market slump, many will need financial help from LGFVs.

“With local government land sales likely plunging this year, grips on LGFVs may be loosened to help fund the spending in infrastructure,” Hui Shan, chief China economist at Goldman Sachs Group Inc., said in an interview. “The PBOC’s comment provides a necessary condition for such a relaxation.”

LGFVs are companies that build subways, roads and other infrastructure projects on behalf of local governments, raising funds through bank loans or bond sales to finance the investment. The debt doesn’t appear on the balance sheets of local governments, yet carries an implicit guarantee of repayment with public money.

The firms have become financially risky in recent years after racking up significant amounts of debt. Policy makers’ tightening stance on the sector and the property market slump last year squeezed funding for firms, putting some at risk of default. China’s State Council -- or cabinet -- said last year that it wanted failing LGFVs to restructure or go bust if they couldn’t repay their debts.

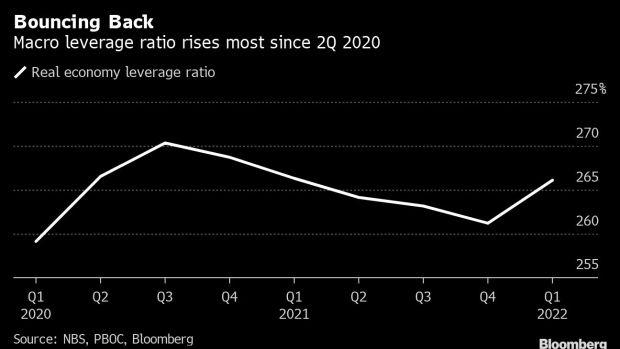

Allowing LGFVs to increase borrowing would boost China’s overall debt levels in the economy. Local governments have already been selling special bonds at a record pace and relaxing curbs on property-related loans. The country’s leverage ratio -- total debt as a percentage of gross domestic product -- climbed in the first quarter for the first time in a year and half to 266.1%.

Despite the surge in local government borrowing, many will need more financing support from LGFVs given the shock of the worst virus outbreak since the pandemic’s onset.

“The budget is approved and it’s extremely hard to be increased. Adjusting LGFV financing policies to expand effective investment could essentially let fiscal policy add leverage off government balance sheet,” Tianfeng Securities Co. analysts led by Sun Binbin wrote in a note after the PBOC announcement.

Weak Confidence

Previous rounds of easing of LGFV policies were preluded by similar statements from the government. In July 2018, the State Council said it would guide financial institutions to ensure reasonable funding to the companies in part of an effort to counter the impact of trade tensions with the U.S. In May 2015, three government agencies including the PBOC urged support for LGFVs’ funding demand for projects under construction.

Both statements were followed by rebounds in LGFV net financing for months, although the strength of the gains varied due to the different levels of policy relaxation specified in regulations announced later to implement the government’s guidances.

The companies’ financing was strained again last year, after the default of a state-owned coal-miner roiled the credit market in late 2020. China’s campaign to eliminate the off-balance sheet borrowing of local governments has also made it more difficult for LGFVs to get new credit.

Net financing through domestic bond issuance fell 15.4% in the first quarter from a year ago, following a growth moderation to 10.6% for all of 2021, according to a report by S&P Global Ratings analysts including Laura Li last week.

“Since 2021, hundreds of planned issuances failed to get a regulator green lights,” they wrote in the report, noting these were mainly weaker and lower-level LGFVs. “As credit differentiation continues, a growing number of LGFVs will likely default on non-standard or private debt in 2022.”

To be sure, the central bank’s tone on LGFV financing support is still cautious. The magnitude of any loosening could be much smaller than what happened in the previous economic downward cycles given the high leverage ratio of the economy and the huge debt burden of local governments in poor areas and small cities.

“The strength of the measures will be very different from what was seen in 2015-2016 and 2008-2009,” said Lu Ting, chief China economist at Nomura Holdings Inc. “This time around, the issue is rather to help many real estate developers and local governments to survive and maintain normal operation.”

©2022 Bloomberg L.P.