Nov 7, 2022

China Deflation Fears Rise as Demand Weakens on Covid Outbreaks

, Bloomberg News

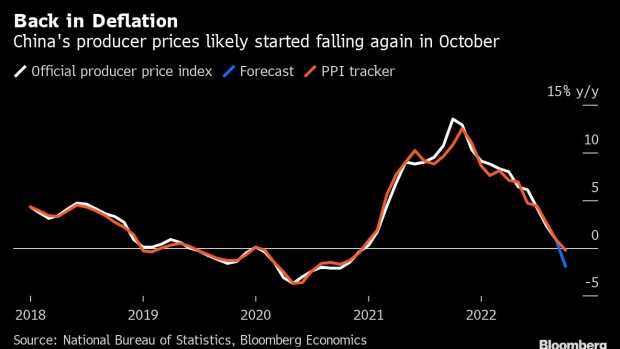

(Bloomberg) -- China is facing increasing deflation pressure as Covid outbreaks and controls cut demand and the falling prices of some commodities put pressure on companies to lower prices.

The producer price index likely fell into deflation in October for the first time in nearly two years, according to the median estimate in a Bloomberg survey of economists head of data due Wednesday. The index is expected to have dropped by 1.6% from a year earlier, after gaining 0.9% in September. Consumer price growth also likely moderated to 2.4% from September’s 2.8% gain.

The data suggests China’s domestic demand has weakened further as movement restrictions to control Covid outbreaks damage spending, export demand falls and home construction continues to shrink, even though policy makers have rolled out measures to boost demand for a range of goods from electric cars to houses. The return of deflation will further hurt corporate profits, although cheaper Chinese exports may be welcomed by shoppers and central bankers in other countries who are facing faster inflation pressures.

“China is falling into a deflationary spiral,” said Raymond Yeung, chief economist for Greater China at Australia & New Zealand Banking Group Ltd. “Domestic demand is very weak,” he said, with producer costs and the core consumer price index that excludes food and energy both trending lower.

Liu He Says Boosting Domestic Demand Key to China Growth: Daily

The drop in some commodity prices is one of the factors in the fall in prices, with the downturn in real estate also weighing on heavy industry prices. Year-on-year price declines in commodities including cement, rebar and copper deepened in October, according to Bloomberg Economics.

“The drop in cement prices was particularly striking -- down more than 30% after a 10% decline in September -- due to a sharply higher year-earlier base,” Eric Zhu, an economist at Bloomberg wrote in a note. “Prices of products upstream, including oil and coal, mostly narrowed gains or widened declines.”

“PPI inflation will be negative through much of 2023” as it tracks the change in global commodity prices, Capital Economics economists including Julian Evans-Pritchard wrote in a note last month.

Consumer prices rises in China have been muted, in stark contrast to most other countries, with the weak price rises driven by subdued demand amid an economic slowdown. The battle with Covid shows no signs of letting up, with fresh lockdowns imposed in several places last month, including part of Zhengzhou, where the world’s largest iPhone factory is located, and some districts of Wuhan, Covid’s original epicenter.

Case numbers also creeping up in other cities like Beijing and Guangzhou, promoting authorities to restrict mobility and close schools.

“Given the poor state of domestic demand, deflation – negative CPI inflation - is not impossible,” said Louis Kuijs, APAC Chief Economist at S&P Global Ratings. “Further weakening of domestic demand could potentially lead to deflation, especially if that is combined with falling energy and commodity prices. This would be a concern.”

But in the meantime, low inflation pressure signals there’s “room for more policy easing,” said Larry Hu, head of China economics at Macquarie Group Ltd. He sees China’s deflation pressure lingering until policy makers take more “decisive” moves to boost demand.

For the wider world, a slowing China could help curb the problem of global inflation. “Ironically, it is China’s contribution to the world in an inflationary world,” ANZ’s Yeung said.

©2022 Bloomberg L.P.