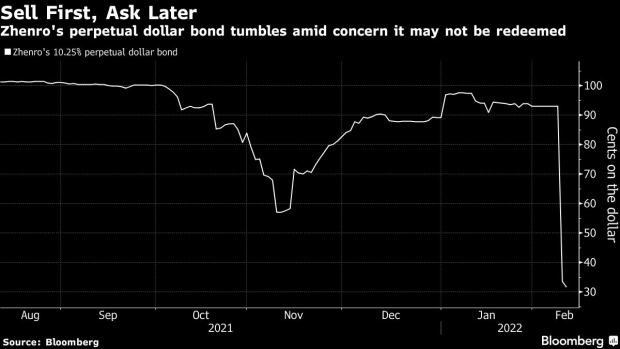

(Bloomberg) -- Zhenro Properties Group Ltd.’s spiraling bond prices show just how risky it is to invest in Chinese developer bonds -- even when a repayment looks imminent.

The firm’s $200 million perpetual bond was trading at 93 cents on the dollar before it plunged 59.3 cents Friday, after concerns emerged that the firm may not proceed with a planned redemption of the note in March. The borrower’s dollar bonds were set to extend declines Monday and its shares were poised for a fresh low after falling about 70% since Thursday.

Transparency worries are resurfacing in China’s real estate sector as investors try to avoid nasty surprises. Concern about hidden debt and a spate of auditor resignations has already prompted a repricing of risk among dollar bonds as creditors reassess developers once deemed relatively resilient to the credit crunch engulfing the industry.

China’s 30th largest builder by contracted sales last year, Zhenro said Monday that articles published on the internet about its controlling shareholder Ou Zongrong and offshore debt securities are “untrue and fictitious.” It didn’t disclose whether it still planned to redeem the perpetual bond.

The company said in an email to Bloomberg that it had no further comment.

“Bondholders with low risk appetite may not be able to stomach the extreme price volatility in the sector and may decide to exit the industry altogether, evident in the quick reaction by Zhenro’s bondholders who sold without waiting for the company’s clarification,” Bloomberg Intelligence analysts including Andrew Chan wrote in a Monday report. Frail investor sentiment may trigger more selling of bonds of developers that are perceived to be financially healthy and whose prices have held up relatively well, Chan said.

©2022 Bloomberg L.P.