Nov 10, 2022

China Quants Seek Billions in New Funds After Sidestepping Rout

, Bloomberg News

(Bloomberg) -- China’s quantitative hedge funds are back raising billions, betting that their recent recovery from a bruising downturn will be enough to entice investors.

Yanfu Investments, founded by former Two Sigma Investments analyst Gao Kang, has opened all products and said it’s now able to run 80 billion yuan ($11 billion), more than double its current size. Beijing-based Ubiquant is planning to raise 2 billion yuan by re-opening a strategy that aims to beat the CSI 1000 Index. They join Jin Ge Asset Management and others in ending a self-imposed freeze.

The flurry of re-openings marks a reversal from late last year when many top quants suspended inflows. The industry’s rapid expansion drew regulatory scrutiny and weighed on performance. Their resilience now faces a new test: Whether they can entice enough investor interest, navigate China’s choppy markets, and avoid attracting further attention from regulators who’ve warned them for disrupting financial markets.

Like their US counterparts Two Sigma and D.E Shaw & Co., Chinese quant funds deploy vast reams of data to build trading algorithms that outperform the market. A relatively new industry, assets at such funds in China have jumped tenfold in four years to exceed 1 trillion yuan as of 2021, according to Citic Securities Co. estimates. They compete with foreign hedge funds and technology giants including Alibaba Group Holding Ltd. and Bytedance Ltd. for talent in computer science and math.

Turning Positive

“Quant funds’ alpha has gradually turned positive this year,” bolstering their appeal to investors, said Qu Tao, head of financial engineering at China Merchants Securities Co., the largest custodian bank of hedge funds in China. By alpha, he refers to the excess returns relative to benchmarks.

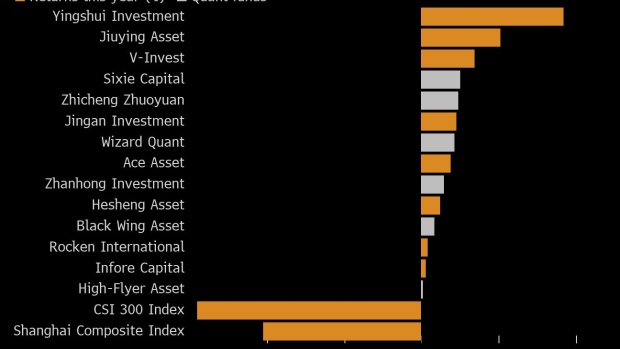

The 28 private quants that each manage more than 10 billion yuan averaged a 2.3% loss this year through Sept. 23, outperforming the 22% slump in the benchmark CSI 300 Index, according to Shenzhen PaiPaiWang Investment & Management Co. They also beat their human-run rivals, which dropped 12%, the data showed.

Zhejiang High-Flyer Asset Management, which apologized to investors in December due to performance and remains closed to inflows, dominated a list of 28 index-enhanced products that delivered positive returns through Sept. 2, with 13 of them averaging a 2.5% gain, according to PaiPaiWang.

Index-enhanced products, which seek to beat indices, along with market neutral offerings, are the most popular strategies. They account for 71% of the 1.08 trillion yuan under management by the industry as of the end of last year, according to AMAC data. Institutional investors contributed about 70% of the money for quants.

China’s retail-investor-dominated market is fertile ground for algorithm-driven strategies that profit from mis-priced securities. That’s part of the reason why quant funds were able to rebound from a slump between September 2021 and March. Even though regulators scrutinized them for market disruption concerns, some funds refuted the idea by providing rare disclosures on strategies, including how they scooped up shares during the selloff.

Quant firms’ tendency of keeping stock positions full -- compared with human-run operations that can cut equity low -- helped them capture the latest rally, said Hu Bo, a fund of hedge funds manager at Rongzhi Investment, PaiPaiWang’s private fund unit. It also helped that many of them focused on small-cap stocks, which outperformed the broader market after April.

Fundraising Again

To further appease regulators, quant firms have been submitting more data to authorities as required, and the past few months saw no further moves of policy tightening, according to fund managers who asked not to be named.

That’s led to a revival in fundraising. Yanfu was among the top five hedge funds for product issuance in August, and Shanghai Sixie Capital Management Co. seized the top spot a month later. Yanfu, which has suspended inflow a few times in recent years, manages about 36 billion yuan, according to distributor Zhongzhi Fund.

Others are joining the rush as well. Jin Ge, which stopped taking money since September last year, is now able to run about 30 billion yuan -- double its current assets -- without destabilizing performance, its founder told CSC Financial in August. Both Yanfu and Jin Ge declined to comment.

Zhicheng-Zhuoyuan (Zhuhai) Investment Management Partnership said it has grown assets by 3 billion yuan this year to more than 10 billion yuan, but will ensure the increased size won’t disrupt its ability to beat benchmarks. Shanghai Goku Data Com Center, which partially froze inflows a year ago, expanded assets by about 2 billion yuan to 12 billion yuan.

Sixie Capital, which beat the CSI 500 Index by 27 percentage points in the first nine months to top PaiPaiWang rankings for quants, said it has expanded assets by about 35% to 13.5 billion yuan this year.

The recent market rally has given a further boost to quants. More than 73% of the index-enhanced products beat gains in their underlying indices by at least 2 percentage points for the week ended Nov. 4, according to Haitong Securities Co.

Investors who are long-term optimistic about A-shares -- stocks traded in mainland China -- and can tolerate some fluctuations should focus on index-enhanced products to gain exposure at low costs, Sixie Capital said in a reply to Bloomberg. That way they can “reap considerable long-term returns.”

That said, quants are facing some stiff competition. Safer options like deposits and insurance are gaining popularity in recent months, said Hu.

“There’s still a lack of confidence and passion in the market, and fundraising remains a challenge.” Hu said.

(Updates with more quant fundraising details in 14th paragraph and last week’s performance in 16th graph)

©2022 Bloomberg L.P.