Mar 4, 2022

China’s 2022 Budget: A Breakdown of The Key Numbers

, Bloomberg News

(Bloomberg) -- China plans to increase spending in 2022 to shore up the slowing economy but also cut the budget deficit, with the government drawing on savings from previous years to pay for the rise in expenditure.

The fiscal gap between general public income and expenditure will be 3.37 trillion yuan ($534 billion) this year, or 2.8% of gross domestic product, according to a report by the Ministry of Finance submitted to the National People’s Congress, the country’s parliament. That compares with last year’s deficit target of around 3.2% and pre-pandemic levels of 3% or lower.

READ: Unraveling the Mysteries of China’s Multiple Budgets: QuickTake

Here’s a look at some of the key budget numbers:

General Public Revenue

This is income mainly from taxes. It’s forecast to increase 3.8% from last year to 21.01 trillion yuan in 2022. Including money from other sources such as carried-over funds and surplus profits of state-owned businesses, total revenue will rise to 23.34 trillion yuan.

General Public Expenditure

This includes spending on public services such as education, health care, disaster relief, and science and technology research, as well as expenditure on defense and payment of the interest of government debt. It’s projected to rise 8.4% to 26.71 trillion yuan.

- Budgeted defense expenditure will go up 7.1% to 1.45 trillion yuan

- Transfer payments from the central government to local authorities will jump 18% to 9.8 trillion yuan. The transfers are intended to help local governments fund basic public services such as compulsory education, pension subsidies and medical insurance, and pay salaries of government employees. This year’s payments also include a one-time transfer of 800 billion yuan from the profits of state-owned financial institutions and monopoly businesses.This will help local governments implement cuts in taxes and fees.

National Budget Deficit

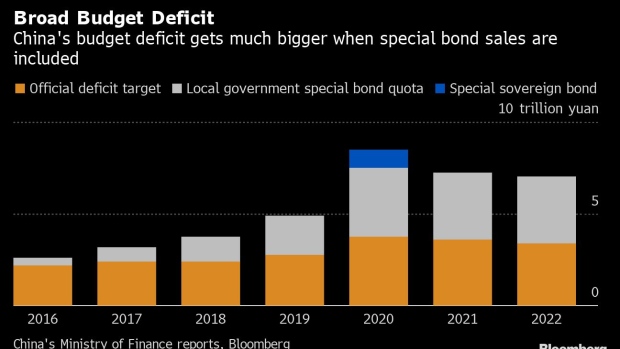

The gap between general public revenue and general public expenditure will come in at 3.37 trillion yuan, compared with 3.57 trillion yuan last year and 3.76 trillion yuan in 2020 when the pandemic started.

The augmented deficit, however, is much larger with the inclusion of the issuance of special local government bonds. Such debt is sold to finance investment in key infrastructures such as highways, city subways, and power grids, and paid back by profits from those projects. This year’s quota of the special bonds is 3.65 trillion yuan, unchanged from last year’s allowance.

Revenue of Government-Managed Funds

About 90% of the revenue of these funds is from land sales. It’s forecast to edge up 0.6% to 9.86 trillion yuan. There was no mention of the projection for revenue from land sales in 2022.

Revenue of State Capital Operations

This revenue includes profits submitted by state-owned enterprises, dividends from state-owned shares, and income from equity sales. It’s expected to drop 1% to 512.81 billion yuan.

Revenue of Social Security Funds

Income from this source is projected to rise 5.8% to 10.03 trillion yuan, including 7.13 trillion yuan in insurance premiums and 2.41 trillion yuan in government subsidies. That will exceed expenditure by 786.08 billion yuan, boosting the cumulative balance by the end of 2022 to 10.93 trillion yuan.

The revenue and expenditure in state capital operations and social security funds are generally used in dedicated sectors and are much smaller than the main budgets.

©2022 Bloomberg L.P.