Oct 17, 2022

China’s BYD Expects Quarterly Profit to Surge as EV Sales Hit Record

, Bloomberg News

(Bloomberg) -- BYD Co. jumped as much as 7.25% in Hong Kong on Tuesday after the Chinese electric vehicle maker said its third-quarter profit may surge up to 365%, another sign the Warren Buffett-backed company is managing to sidestep supply chain snags and capitalize on strong consumer demand.

Net income is forecast to come in between 5.5 billion yuan ($765 million) and 5.9 billion yuan, which would be a record, the Shenzhen-based group said late Monday. BYD is benefiting from making its own batteries and semiconductors, helping it avoid disruptions that have hurt rivals, including Elon Musk’s Tesla Inc.

See also: China’s BYD Aims to Rule EV World by Being Anything But Tesla

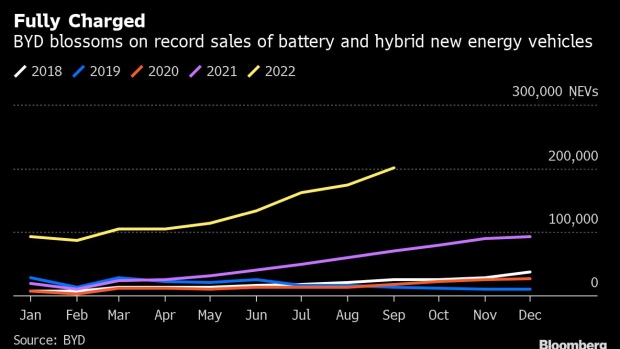

Sales volume of new energy vehicles -- including EVs and hybrids -- also reached record highs, BYD said in a stock exchange filing detailing estimated results for the quarter ended Sept. 30. That drove a “significant improvement in earnings” and helped relieve “the pressure on earnings brought by the rising prices of upstream raw materials.”

The forecast follows a strong first half of 2022, when BYD’s net income tripled from a year earlier to 3.6 billion yuan, the top end of its preliminary guidance. Still, there is some uncertainty surrounding the company after Buffett’s Berkshire Hathaway Inc. trimmed its stake in the third quarter.

Read more: Buffett’s Berkshire Offloads More Shares in EV Giant BYD

The EV maker is also set to boost net income in the combined three quarters for the year to 9.5 billion yuan, up as much as 289%, according to the filing.

BYD sold 537,164 electric and hybrid cars in the latest three month period, up 197% from a year earlier. The total comfortably beat Tesla, though Tesla only sells pure EVs.

Growing demand for EVs is lifting the broader industry. Leading battery maker Contemporary Amperex Technology Co. Ltd. said on Oct. 10 its third-quarter net income could surge as much as 200% thanks to booming sales, while LG Energy Solution Ltd.’s operating profit and sales beat expectations on strong demand.

BYD is continuing its overseas expansion, including product launches in India, Thailand, Laos, Mongolia and Nepal in recent weeks, and a distribution agreement in Malaysia with Sime Darby Motors Sdn Bhd. That caps a summer push across Europe and an announcement that BYD will build its first passenger EV plant in Southeast Asia.

BYD shares are down around 23% this year.

(Updates with share move details.)

©2022 Bloomberg L.P.