Mar 8, 2024

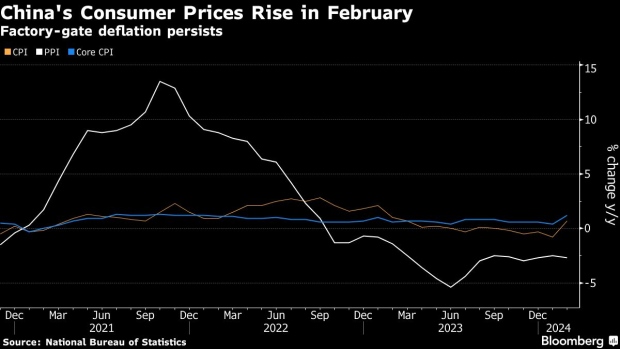

China’s Consumer Prices Rise for First Time Since August

, Bloomberg News

(Bloomberg) -- China’s consumer prices rose for the first time since August, breaking a contraction streak that has put growth potential in the world’s second-largest economy under pressure.

The consumer price index increased 0.7% in February from a year earlier, according to the National Bureau of Statistics on Saturday, rebounding from the biggest drop since 2009 in January. The gain was higher than analysts’ estimates of a 0.3% gain in a Bloomberg survey.

Producer prices fell 2.7%, continuing the longest string of declines since 2016.

“I think it is too early to conclude that deflation in China is over,” said Zhang Zhiwei, president and chief economist at Pinpoint Asset Management. “Domestic demand is still quite weak. It takes time for the fiscal boost to be transmitted to the economy and help domestic demand to recover.”

The price rebound — while welcome news for policymakers and investors concerned about the country’s deflationary trend — was helped by the Lunar New Year holiday temporarily boosting demand. China has been desperate to perk up price growth as consumers and investors pull back.

A boom in travel during the holidays drove most of the growth in consumer prices, according to Dong Lijuan, chief statistician at the NBS. The decline in producer prices is in part due to slower industrial activities during the holiday period, Dong said.

The data comes after the country’s leadership outlined additional economic support measures at the start of its annual parliamentary session Tuesday. Beijing said it aims to spur economic growth of around 5% this year — similar to last year’s, though a more ambitious target this time around.

Among other stimulus, authorities have detailed plans to issue 1 trillion yuan ($139 billion) in ultra-long special sovereign bonds and tap into additional unspent funds from late last year. Policymakers set a target inflation rate of 3%.

Economists are questioning the government’s ability to spur demand. The real estate sector remains a vulnerability and consumers have increasingly plowed funds into savings rather than spending.

Unlike other countries including the US that are struggling to contain price growth, China is facing a period of deflation after the initial post-pandemic reopening boost. The risk is that weaker prices prompt consumers to increasingly hoard cash and companies to rein in spending, further weighing on economic growth.

Consumer prices on a core basis, which strips out volatile food and energy costs, rose 1.2% from the prior year, the government data showed. That’s the highest in more than two years and compares with a just 0.4% gain in January.

--With assistance from Zhu Lin.

(Updates with economist comment in fourth paragraph.)

©2024 Bloomberg L.P.