Nov 13, 2023

China’s Credit Growth Weaker Than Expected in October

, Bloomberg News

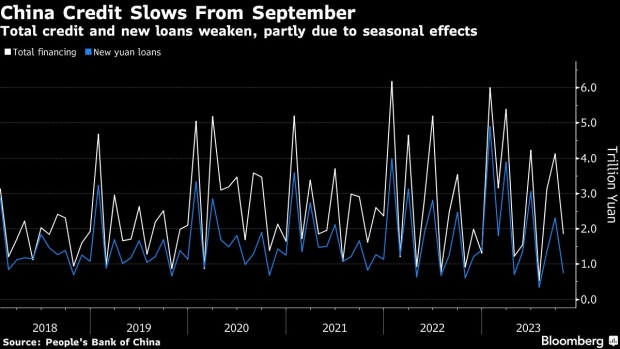

(Bloomberg) -- China’s credit growth remained steady in October, with a big jump in government bond sales to finance stimulus compensating for weak business and household borrowing as well as a large contraction in shadow financing.

The flow of aggregate financing, a broad measure of credit, was 1.85 trillion yuan ($254 billion), the People’s Bank of China said Monday. That missed economists’ expectations of a 1.95 trillion yuan increase.

October’s credit expansion relied mainly on issuance of government debt, which took up the biggest share since 2018, showcasing weakness in the private sector. The stock of aggregate financing last month rose 9.3% from a year before, capping the longest string of sub-10% growth rates on record.

Economists have been closely watching for a pick-up in loan demand as a barometer of China’s economic recovery. A housing market slump combined with low corporate confidence in some sectors has led to relatively slow credit expansion this year.

Growth in yuan-denominated loans slowed to 10.9% year-on-year in October, the lowest pace since April 2022. Economists said the data showed low corporate demand for loans to make long-term investments.

Policy Implication

“Credit demand is still weak,” said said Ming Ming, chief economist at Citic Securities Ltd. “Under the goal of lowering borrowing costs for the real economy and supporting domestic demand, there’s still space for monetary policy to be stepped up.”

An unseasonal jump in government bond sales is boosting credit, with 2.6 trillion yuan worth of new government debt sold in September and October to pay for stimulus mainly in the form of infrastructure investment — supported by the PBOC releasing long-term liquidity into the financial system by cutting the reserve requirement ratio.

Government bond sales accounted for nearly 85% of the month-on-month credit increase, the highest share since at least 2018, according to Bloomberg calculations.

Nonfinancial companies borrowed a net 516 billion yuan in the month, helped by more than 300 billion yuan in short-term bill financing. The bills are often used by banks to increase the size of their lending books and meet regulatory requirements in times of weak borrowing demand.

The reliance on bill financing to drive growth suggests “the structure of credit is still not good,” Citic’s Ming said. New corporate medium- and long-term loans, which reflect companies’ willingness to expand investment, increased by less than in October last year.

The data also suggested weak household confidence.

October saw 71 billion yuan of additional medium- and long-term loans to households — a proxy for mortgages — compared with the previous month. That was a smaller bump than seen in September.

The figures are a sign of “feeble housing sales after developer debt issues came to the fore again,” notably at China Evergrande Group and Country Garden Holdings Co., according to Duncan Wrigley, chief China economist at Pantheon Macroeconomics.

Household short-term loans shrank by 105 billion yuan, the biggest drop for October in data back through 2007.

Weaker Demand

The growth of broad money supply as measured by M2 was unchanged from a month ago at 10.3%.

However, M1, which measures currency in circulation and demand deposits, only grew 1.9%. The widening gap between the two indicators was cited by analysts as a sign of muted business activity and precautionary saving by households and businesses.

“The widening gap between M1 and M2 is a worry. It suggests that firms aren’t holding cash balances for transaction purposes, but rather for savings, which would be negative for near-term growth,” said Adam Wolfe, an economist at Absolute Strategy Research.

The amount of credit from the shadow banking sector fell by almost 260 billion yuan, the biggest drop since mid-2022. Some parts of China’s shadow banking industry, such as investment trusts, have been hit by liquidity problems due to the slumping real estate market.

Last month, the PBOC said outstanding property loans in the quarter that ended in September fell on a yearly basis for the first time on record — underlining the stress in the sector, despite official assurances that the government is working to stabilize it.

“The data suggests to me an economy that is stabilizing with the help of strong government support, but one that is far from re-acceleration,” said Rory Green, China economist at TS Lombard.

--With assistance from Tom Hancock.

(Updates with details and economists’ comments throughout.)

©2023 Bloomberg L.P.