Oct 16, 2022

China Won’t Rush Its Clean Energy Transformation, Xi Says

, Bloomberg News

(Bloomberg) -- President Xi Jinping has promised a slow and steady end to the growth of planet-warming emissions in China, with energy security taking top priority as the country contends with a flagging economy and tumult on global fuel markets.

In a two-hour speech to kick off the weeklong Communist Party Congress, Xi said that prudence would govern China’s efforts to peak and eventually zero out carbon emissions. The cautious wording comes after a spate of high-profile power shortages in recent years, and as global energy costs have soared after Russia’s invasion of Ukraine upended trade flows.

Xi’s speech made China’s path to decarbonization clear: It won’t stop burning fossil fuels until it’s confident that clean energy can reliably replace them. The speech shows more emphasis on energy security and the significant role of coal in China’s energy supply given the resources endowment, said Qin Yan, lead analyst with Refinitiv.

“We will work actively and prudently toward the goals of reaching peak carbon emissions and carbon neutrality,” Xi said in his address. “Based on China’s energy and resource endowments, we will advance initiatives to reach peak carbon emissions in a well-planned and phased way, in line with the principle of getting the new before discarding the old.”

China is the world’s largest emitter of greenhouse gases, and Xi electrified climate activists two years ago when he vowed to reach carbon neutrality by 2060 after peaking emissions before 2030. The announcement sparked a massive surge in investment in clean energy by local governments and state-owned firms.

Read: How Xi’s Green Dream has been tested by a weak economy and global strife

But last year focus began to return to China’s mainstay fuel of coal after a shortage triggered widespread power curtailments to factories, slowing economic growth. The country vowed to increase mining capacity, and production has risen to record levels this year, keeping storage sites well stocked and reducing imports.

China will also expand exploration and development of oil and gas resources, and increase reserves and production as part of the measures to ensure energy security, according to a congress work report released after Xi’s speech.

China invests more than any other country in clean energy, and is on pace to shatter its record for new solar installations this year. But it hasn’t been able to outrun the growth in energy demand, forcing it to burn more coal and setting a record for consumption last year that is likely to be eclipsed in 2022.

Xi made clear that fossil fuels and renewables will have to work in tandem. “Coal will be used in a cleaner and more efficient way and we will speed up the planning and development of new energy systems,” he said.

He also vowed that China would be actively involved in the global response to climate change. His government was criticized after it broke off climate negotiations with the US in August after House Speaker Nancy Pelosi’s visit to the contested island of Taiwan.

Events Today

(All times Beijing unless noted otherwise)

- Communist Party Congress in Beijing

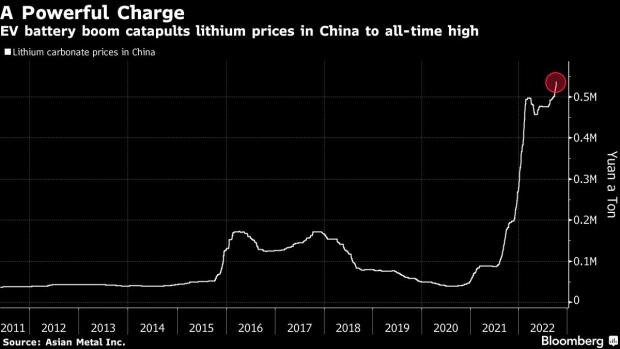

Today’s Chart

Lithium prices are going through the roof in the latest leg of a record-setting rally as global demand for the key battery ingredient booms while supply remains constrained. In China, lithium carbonate has hit 537,500 yuan ($75,000) a ton, accordincg to a gauge from Asian Metal Inc., near double the level at the start of the year. Electric-vehicle sales in China, the biggest market by far, surged 83% year-on-year in September.

On The Wire

- China Energy Firms in Focus as High Oil Prices Lift Cnooc Profit

- Chinese Developers’ Price, Earnings Cut at Citi on Weak Outlook

- Chinese Banks Announce Credit Expansions to Support Economy

The Week Ahead

Tuesday, Oct. 18

- Communist Party Congress in Beijing

- Rio Tinto quarterly production report, 08:30 Sydney

- China Sept. industrial output, incl. steel & aluminum; coal, gas & power generation; and crude oil & refining. 10:00

- Retail sales, fixed assets, property investment, residential property sales, jobless rate

- 3Q GDP

- 3Q pork output and inventory levels

- Retail sales, fixed assets, property investment, residential property sales, jobless rate

- China’s 2nd batch of Sept. trade data, incl. agricultural imports; LNG & pipeline gas imports; oil products trade breakdown; alumina, copper and rare-earth product exports; bauxite, steel & aluminum product imports

Wednesday, Oct. 19

- Communist Party Congress in Beijing

- BHP Group quarterly production report, 08:30 Sydney

- China new home prices for September, 09:30

- EARNINGS: HKEX

Thursday, Oct. 20

- Communist Party Congress in Beijing

- China sets monthly 1 and 5-year loan prime rates, 09:15

- China Sept. output data for base metals and oil products

- China’s 3rd batch of September trade data, including country breakdowns for energy and commodities

- USDA weekly crop export sales, 08:30 EST

Friday, Oct. 21

- Communist Party Congress in Beijing

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

- EARNINGS: Zijin Mining, CATL

©2022 Bloomberg L.P.