Dec 19, 2022

Chinese Funds Dump Record Amount of Bonds Amid Redemptions

, Bloomberg News

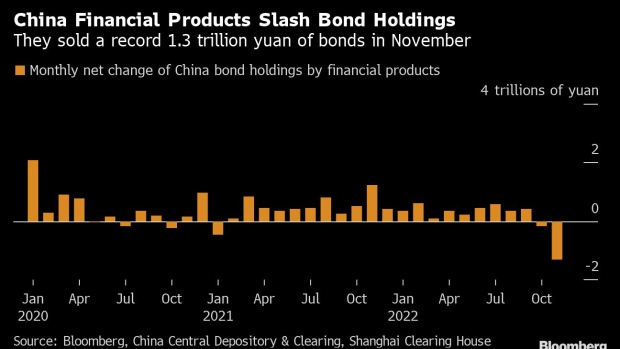

(Bloomberg) -- Heavy redemptions by China’s retail investors are prompting the nation’s financial product managers to slash their bond holdings like never before. Some analysts say that the debt selloff is far from over.

Managers of domestic mutual funds and wealth management products offloaded 1.3 trillion yuan ($186 billion) of bonds from the interbank market last month, the most on record, according Bloomberg calculations based on Chinabond and Shanghai Clearing House data going back to 2017.

The outflow is nearly twice the size of global funds’ sales of China’s bonds so far this year and shows the rising influence of individual investors in the nation’s debt market. China bonds have been caught in a downward spiral since November as the nation started easing its strict Covid rules, a move that was exacerbated by an exodus of retail investors from funds including wealth management products.

The shock wave of wealth management product redemptions has not ended yet, Yan Ziqi, analyst at Huaan Securities, wrote in a note. The amount of maturing products will remain high in the first quarter of next year, allowing more retail investors to pull back their money, he said.

To moderate the redemption shock, regulators were said to have asked some banks’ proprietary trading desks and insurers to buy bonds. The People’s Bank of China also pumped more cash than forecast into the banking system in December, in a move that’s seen as bolstering bonds.

Relatively liquid bonds were heavily sold off last month, according a Haitong Securities Co. note. Going forward though, government bonds may stabilize sooner than credit given the ample liquidity and the likely flow-back of the redeemed cash as bank deposits, analysts led by Jiang Peishan wrote.

Banks’ negotiable certificate of deposits, policy bank bonds and corporate notes were among the most heavily sold securities by funds including WMPs last month, according to Bloomberg calculations. Financial products held 35.7 trillion yuan of China bonds at the end of November, about 28% of the total interbank market.

China’s benchmark 10-year government bond yield surged 24 basis points in November while corporate credit saw the biggest selloff in five years. The 10-year sovereign bond yield has eased after jumping to the highest in over a year this month.

©2022 Bloomberg L.P.