Jan 13, 2023

Chip-Stock Rally Flies in Face of Weakening Tech Outlook

, Bloomberg News

(Bloomberg) -- Semiconductor shares have led the US stock market’s recovery over the past three months even as the outlook for the industry darkened, leading to plenty of skepticism that the rally can go much further in the short term.

The problem for would-be bulls is that demand for chips, particularly for those used in smartphones and personal computers, is still tanking. That’s led to weak quarterly results or warnings of disappointing sales from bellwethers such as Samsung Electronics Co. and Taiwan Semiconductor Manufacturing Co.

The Philadelphia Stock Exchange Semiconductor Index fell 0.9% on Friday, dipping after five straight positive sessions.

“For stocks to move significantly higher from here, there’s got to be a sustained recovery in the second half of the year,” Toshiya Hari, the lead analyst covering the sector at Goldman Sachs Group Inc., said in a phone interview. “There’s a lot of hope, but limited evidence that we’ll see a significant recovery.”

The semiconductor index is up 28% from its October low. The surge has lifted valuations above their long-term average, making it difficult to find attractive stocks.

The industry, the most cyclical part of technology, boomed at the height of the Covid pandemic as demand for chips used in everything from laptops to cars skyrocketed. Fortunes have rapidly turned now and chipmakers are scaling back their capital spending as demand falls.

Hari says 2023 will be a “correction year” as the auto and industrial end markets follow memory and PCs in seeing a slowdown in growth, a view supported by the latest monthly sales data from the Semiconductor Industry Association.

In addition to Samsung and Taiwan Semiconductor, smaller companies including Ichor Holdings Ltd. and Ultra Clean Holdings Inc. have also come out with weak forecasts, citing headwinds that continue to gnaw at the industry.

Analysts have been slashing their estimates. Semiconductor earnings are expected to fall 16% in 2023, while revenue drops 4.4%, according to Bloomberg Intelligence data. Six months ago, the consensus was for profits to rise 5.9% and sales to be up 7.4%. The S&P 500 Index is expected to show growth in both metrics this year.

The chip index is still trading at 18.4 times estimated earnings even after slumping by more than a third last year. The valuation compares to a 10-year average of 16.4. Should consensus estimates drop further, that would make stocks appear even pricier by lowering the denominator in the price-earnings ratio.

While chipmakers can bolster their profitability by cutting spending, that bodes ill for the makers of equipment to produce semiconductors such as Applied Materials Inc. and KLA Corp. Wells Fargo Securities sees 2023 as a “choppy” year for those companies and recommends a “defensive positioning” in them, citing the prospect of another leg down in estimates in the second half.

Still, investors for now are assuming the best for the chip industry. Taiwan Semiconductor shares have risen the past two days, even after the chip giant signaled this quarter could mark its first revenue drop in four years.

“It’s interesting that now whenever we get bad news and it seems like the companies are forthright, even though it’s worse than expected, the stock goes up,” said Dan Morgan, a senior portfolio manager at Synovus Trust Co. The industry is likely to have subpar growth through 2023, he said.

Tech Chart of the Day

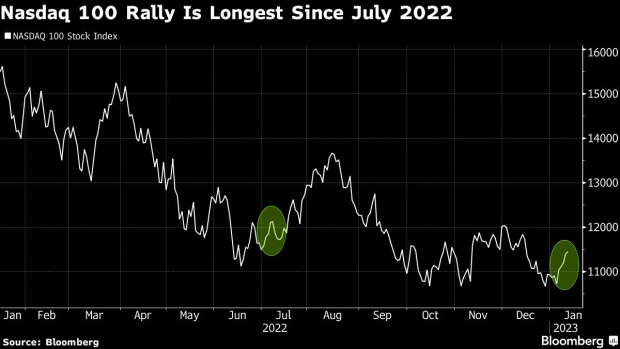

Growing optimism that inflation has peaked is helping lift stock prices early in the new year, and tech has been one of the biggest beneficiaries. The Nasdaq 100 Index rose Thursday for a fifth straight session, its longest winning streak since July. The index has advanced 6.7% over the period.

Top Tech Stories

- Apple Inc. is cutting Chief Executive Officer Tim Cook’s compensation by more than 40% to $49 million in 2023, citing investor guidance and a request from Cook himself to adjust his pay.

- Alphabet Inc.’s Google and Nvidia Corp. have expressed concerns to the Federal Trade Commission about Microsoft Corp.’s acquisition of Activision Blizzard Inc., adding fuel to the government’s case against the $69 billion deal, according to people familiar with the matter.

- As renowned activist investor Nelson Peltz prepares for a major public showdown with Walt Disney Co., he’s taking cues from an old playbook, created in the heyday of corporate raiders.

- Chinese government entities are set to take so-called “golden shares” in units of Alibaba Group Holding Ltd. and Tencent Holdings Ltd., suggesting Beijing is moving to ensure greater control over key players in the world’s largest internet arena.

- Taiwan Semiconductor jumped 2.8% Friday after investors bet the world’s most valuable chipmaker would be among the first to emerge from an industry downturn in 2023.

- President Joe Biden will discuss cooperation on limiting China’s access to semiconductor technology in back-to-back visits to Washington by leaders of Japan and the Netherlands in the coming days.

(Updates to market open.)

©2023 Bloomberg L.P.