Oct 13, 2022

Citi Says Dollar Peak Will Only Come When World Economy Recovers

, Bloomberg News

(Bloomberg) -- The dollar is likely to keep rallying until the current slowdown in the global economy is over and growth starts to accelerate again, according to Citigroup Global Markets Inc.

Until then, the US currency is the “safest place to hide,” particularly as it offers a yield premium over its global peers, Citi strategists including Jamie Fahy in London wrote in a research note.

“What we think is needed for a dollar top is a bottom in global growth,” the strategists said. “There needs to be a narrative shift in order to change the trajectory of the dollar.”

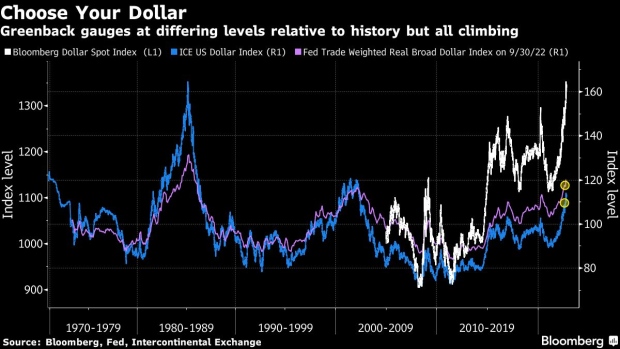

A debate is raging as to when the current surge in the world’s reserve currency will end. The ICE US Dollar Index, which track the greenback against six of its global peers, has climbed more than 18% this year, heading for a record annual gain in data starting in 1972.

Dollar strength was a major topic at gatherings of finance chiefs and central bankers in Washington this week as the soaring US currency adds to economic challenges facing governments around the world. Strategists say relief remains a fair way off, especially after US Treasury Secretary Janet Yellen said this week the greenback’s strength is the “logical outcome” of different global monetary policy stances.

Even a decision by the Fed to slow rate hikes may not be enough to convince the majority of investors to sell the dollar, according to Citigroup. An improvement in the global growth outlook remains key as this has been the main driver of the dollar’s past reversals, particularly in the last two decades, the strategists said.

“The top in the USD probably only arrives when the Fed is cutting and global growth ex-US is bottoming,” they wrote.

©2022 Bloomberg L.P.