Aug 26, 2022

CMBS Money Is Pouring Into Florida and N.J. Office Spaces

, Bloomberg News

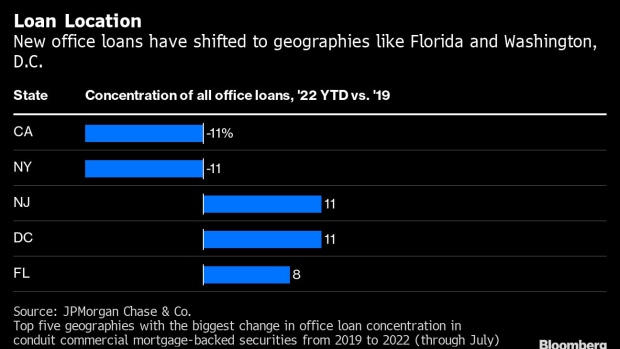

(Bloomberg) -- Bond investors are increasingly financing office space in Florida and New Jersey, states seen as potential winners as the Covid pandemic spurs more employees to cut down on commuting into cities in New York and California.

As much as 10% of the office mortgages that get bundled into new bonds are tied to Florida so far this year, up from just 2% before the pandemic, according to data from JPMorgan Chase & Co. New Jersey’s share has grown to 15% from 4%.

Loans in New York, meanwhile, have represented just 15% of the pool of office loans in CMBS this year, down from 26% in 2019. The JPMorgan data focuses on mixed-property commercial mortgage bonds known as “conduits,” and while its hard to know exactly what this means long term, it does reflect where economic value is rising now, said Chong Sin, an executive director and CMBS research lead at the bank.

“Lending capital is following companies to Florida and other, less costly areas,” Sin said.

Florida has long been known for its gleaming coastal hotels and high-rises, but over the last two years, a number of high-profile companies have increasingly set up offices or moved to the Sunshine State. That includes Ken Griffin’s Citadel, which is establishing its headquarters in Miami and building a skyscraper there.

“Save for a few lagging markets, the southeast, southwest and sections of the Midwest have largely benefited from an uptick in office usage resulting in improving fundamentals,” said Will Sledge, a senior managing director in the capital markets unit of brokerage Jones Lang LaSalle Inc., and co-head of the firm’s national loan sales platform.

There’s at least one other part of the US that has seen a large increase in office mortgages in conduit deals: Washington, DC. Around 12% of the office loans so far this year are tied to DC, compared with just 1% in 2019.

As CMBS investors take on exposure to office space in places like Florida and New Jersey, they are cutting it down elsewhere. Just 19% of loans for offices in conduit deals so far this year are tied to California, a steep drop from 30% in 2019.

Will these office lending trends hold? That depends on whether the main underlying drivers -- including population growth in Sunbelt states and employees working from home more often -- continue.

That in turn relies on what new working norms emerge in the post-Covid era, said Chong, the co-author of a recent note on what work-from-home means for CMBS.

“The debate is whether these migration patterns hold over the longer run, which is partially driven by how deeply ingrained remote work becomes,” Chong said.

Relative Value: CMBS

- Vast majority of CMBS conduit office loans rated single A and higher would be insulated even if occupancy falls 30%, according to JPMorgan analysts

- CMBX BBB- Series 10 is the “sweet spot to add fundamental long-risk exposures” at current price levels, wrote analysts Chong Sin, John Sim, Yong Wang and David S Kaminsky

Quotable

“The fourth consecutive month of increase in the inventory of completed homes for sale suggests to us that builders may begin to discount current asking prices in order to move completed inventory,” said Doug Duncan, chief economist at Fannie Mae, commenting on this week’s new residential sales report from the Census Bureau.

What’s next?

ABS deals in the queue include Carvana (prime auto loan ABS).

©2022 Bloomberg L.P.