Dec 13, 2023

Coinbase to Offer Spot Crypto Trading Outside US in Global Expansion

, Bloomberg News

(Bloomberg) -- Coinbase Global Inc. is rolling out spot crypto trading on its international exchange as part of a global expansion, saying some users are wary of US venues due to the country’s uncertain regulatory backdrop.

Institutional investors can initially trade Bitcoin and Ether against the USDC stablecoin from Thursday on the international platform, which currently focuses on derivatives, the company said in a statement.

“It’s really important to have both spot and derivatives trading side by side,” Greg Tusar, head of institutional product at Coinbase, said in an interview. “They help each other and ensure there’s a deep and liquid market. It’s part of an aggressive and very exciting road map.”

The US Securities and Exchange Commission is suing Coinbase for allegedly running an illegal exchange, broker and clearing agency. The nation’s largest digital-asset platform disputes the claims, which are part of a broader SEC crackdown following a string of crypto collapses headlined by the FTX wipeout.

The SEC has also sued the Kraken and Binance exchanges for failing to register with the agency. Both companies have rejected the watchdog’s arguments. Meanwhile, the slow progress of crypto-related bills through Congress adds to the murky regulatory outlook in the US.

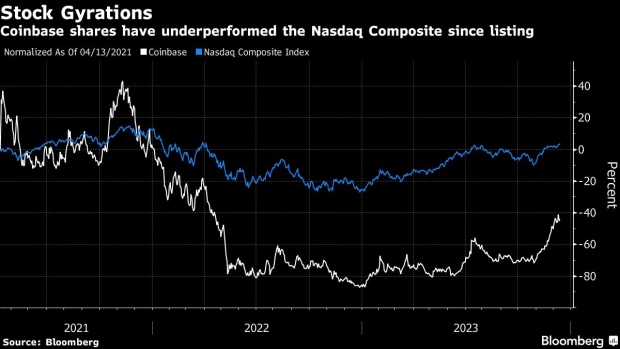

The crypto market has partially rebounded from a rout in 2022, in part because investors expect the US to allow its first spot Bitcoin exchange-traded funds in coming weeks. Coinbase’s stock has roughly quadrupled this year to about $140 per share but traded above $300 back in 2021.

Binance is the largest digital-asset exchange globally but its dominance has waned amid a web of official probes, opening up opportunities for rivals. Binance last month pleaded guilty to US anti-money-laundering and sanctions violations and was hit with a $4.3 billion penalty.

Coinbase started its international exchange in May as part of efforts to diversify away from the US. It intends to list more tokens on the platform over time and open up offshore spot trading to retail investors as liquidity builds. Tusar said hosting spot and derivatives activity on the same venue can boost volumes.

©2023 Bloomberg L.P.