Dec 5, 2023

Crypto Firm Phoenix Jumps 50% After $371 Million Abu Dhabi IPO

, Bloomberg News

(Bloomberg) -- Cryptocurrency mining hardware retailer Phoenix Group Plc jumped 35% on its Abu Dhabi debut, as the first crypto-related listing in the Middle East surged amid a rally in Bitcoin.

That gave the six-year-old company a market capitalization of 12.3 billion dirhams ($3.3 billion). The stock closed at 2.03 dirhams Tuesday, up from the IPO price of 1.50, having earlier risen as much as 51%.

The offering comes as Bitcoin topped $42,000 on optimism that the US will allow its first spot exchange-traded funds and hopes that the worst of a regulatory crackdown is over.

“The outstanding performance of the issue is due to the shortage of public market proxies for this sector,” said Nirgunan Tiruchelvam, head of consumer and internet at Aletheia Capital. “It could spur further crypto issues in the United Arab Emirates.”

The UAE had sought to position itself as a hub for the crypto industry, but has gradually started to tighten scrutiny as it seeks to ensure proper oversight and work toward getting off the Financial Action Task Force’s “gray list.” Dubai’s crypto regulator fined 18 firms for compliance breaches last month.

International Holding Co., Abu Dhabi’s largest conglomerate controlled by a key member of the emirate’s royal family, bought a 10% stake in Phoenix in early October.

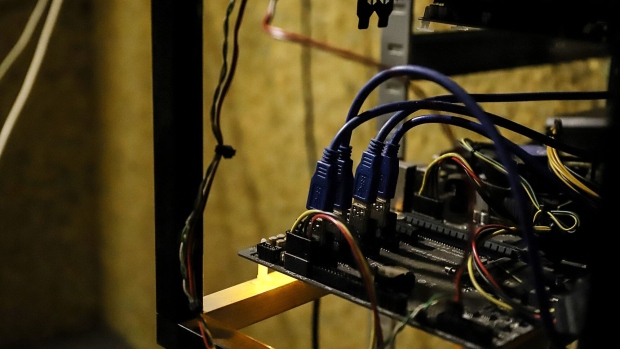

In addition to being a mining equipment retailer, Phoenix operates crypto data centers and recently set up the UAE’s first fully-regulated digital asset exchange, M2.

It made a net profit of $144 million on revenue of $230 million for the nine months until Sept. 30, according to its prospectus. Its gross profit for the same period was $76 million. The firm says it has 725 megawatts of mining capacity globally, which would make it among the largest Bitcoin miners in the world.

Phoenix’s initial public offering drew strong demand and was 33 times oversubscribed — implying orders worth $12 billion — while the portion reserved for retail investors was oversubscribed 180 times. In all, the IPO raised 1.36 billion dirhams.

IPOs in the Persian Gulf have been on a tear in the past two years, underpinned by high oil prices, government privatization programs and strong investor demand. The boom stands in sharp contrast to the subdued listings market globally, which has been pressured by aggressive interest rate hikes and concerns about economic growth.

--With assistance from David Pan.

(Recasts throughout with Bitcoin background, share price close, quote)

©2023 Bloomberg L.P.