Mar 4, 2020

Desperate for Debt Relief, Lebanon Hatches Plan to Avoid Default

, Bloomberg News

(Bloomberg) --

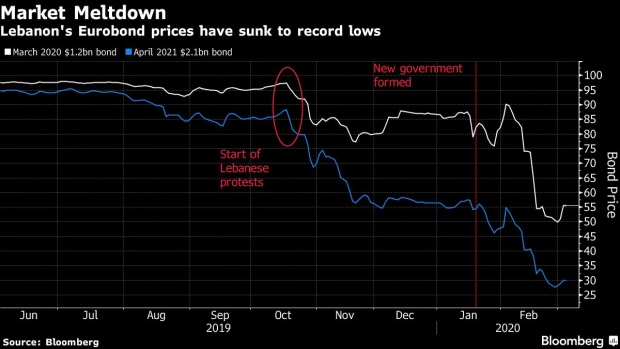

Lebanon’s government is lurching from one extreme solution to another as it wrangles over whether to repay $1.2 billion of notes maturing in five days.

In the latest twist of its effort to avoid a default, it may revive an offer for a debt swap with local holders of its Eurobonds. At a meeting with bankers Tuesday, the finance minister proposed that Lebanese banks swap their entire Eurobond holdings for new debt with lower coupons, a person familiar with the talks said.

Under the plan, the government would pay around $3.5 principal and interest this year to foreign bondholders, said the person, who asked to remain anonymous because the information isn’t public.

One of the world’s most indebted nations, Lebanon is desperate for relief from a burden many economists say is unsustainable. Among the few options left to avoid a default is a swap with local lenders, the biggest holders of Lebanon’s sovereign debt with $13.8 billion of Eurobonds at the end of December, or nearly 44% of the total.

Lebanese officials have said it would be harder for the nation to reach a restructuring agreement if foreigners own large amounts of its bonds.

Another way out for Lebanon is thorough a loan program from the International Montery Fund. Although IMF experts held meetings in Beirut last week, the issue of securing assistance from the fund has become a politically charged issue. Hezbollah, an Iran-backed group that has a major say in government and parliament, has rejected the idea.

A previous swap proposal unraveled after rating companies said they might view it as a distressed exchange and downgrade Lebanon.

Local banks have lobbied against a default and said the country should live up to its spotless track record of repaying debt. The likelihood for a potential restructuring has only grown, however, after the government hired financial advisers Lazard Ltd. and law firm Cleary Gottleib Steen & Hamilton last week.

Few Options

The government has also come under pressure from several lawmakers and officials to avoid using the central bank’s dwindling reserves to repay its debt.

Since the central bank first proposed swapping domestic holders into longer-dated notes in January, local banks offloaded some of their Eurobond holdings at a discount to overseas investors such as Ashmore Group, a British fund that’s bet the government would pay out. Most of the country’s dollar bonds trade at less than 30 cents, while the March 9 notes trade at 56.

The transactions are now at the center of a government investigation. The Justice Ministry has asked the prosecutor to investigate the sales on the ground that local banks might have obstructed the government’s efforts to restructure debt.

--With assistance from Paul Wallace.

To contact the reporter on this story: Dana Khraiche in Beirut at dkhraiche@bloomberg.net

To contact the editors responsible for this story: Lin Noueihed at lnoueihed@bloomberg.net, Paul Abelsky, Paul Wallace

©2020 Bloomberg L.P.