Jun 1, 2022

DWS Chief’s Days Were Already Numbered When Police Showed Up

, Bloomberg News

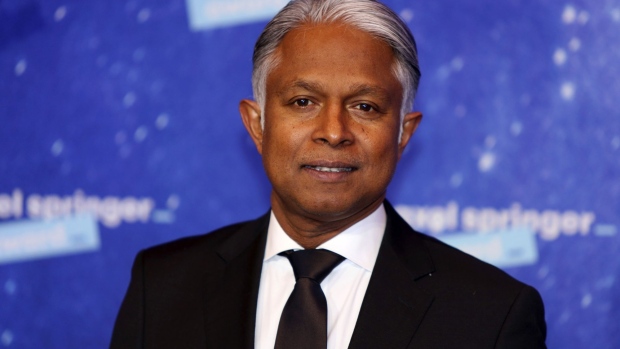

(Bloomberg) -- Asoka Woehrmann didn’t know that police were going to search the headquarters of Deutsche Bank AG’s asset-management arm in Frankfurt on Tuesday morning, but when they arrived it quickly became clear his time as chief executive officer was over.

As footage of officers and prosecutors entering the building to investigate greenwashing allegations at DWS Group hit the wires, the chances of the 56-year-old executive pulling off a face-saving exit after months of controversy vanished.

Read More: Deutsche Bank Replaces DWS’s Woehrmann After Greenwash Raid

Deutsche Bank’s leaders had been consulting with Woehrmann as they drew up plans to replace him with corporate bank chief Stefan Hoops before DWS’s June 9 annual meeting, according to people with direct knowledge of the discussions. The raid rapidly brought that plan forward. A few hours later, the terms of his departure were set and the lender announced his resignation minutes before 4 a.m. local time on Wednesday.

The unceremonious exit ended a career at the German lender spanning more than two decades that made Woehrmann a key ally of Deutsche Bank CEO Christian Sewing, ultimately putting him in charge of overseeing almost $1 trillion in client assets at one of Europe’s largest money managers. Woehrmann also became a key proponent of the trend toward environmental, social and governance-based investing -- and then a lightning rod for discontent over its inflated claims.

Read More: DWS Sends ‘Shock Waves’ Through ESG Fund Management Industry

This account is based on conversations with more than a dozen people close to Deutsche Bank and DWS who all asked not to be identified because of the sensitivity of the matter. Spokespeople for DWS and Deutsche Bank declined to comment.

The beginning of Woehrmann’s end as DWS CEO arguably came in a small meeting room at the firm’s Frankfurt headquarters in February last year. He was sitting across from Desiree Fixler, an American executive he had hired only the previous year to drive DWS’s ambitious sustainability efforts, and he told her during a sometimes-heated exchange that she was going to get fired.

Fixler, who has said she spoke up internally about glaring discrepancies between DWS’s public claims regarding its ESG capabilities and its internal procedures, was sacked two weeks later.

Frustrated, she compiled evidence allegedly showing how DWS under Woehrmann had been overstating to investors how much its fund managers were considering ESG factors when picking assets.

The departure of a chief executive officer amid allegations of greenwashing may mark a new era for accountability for an industry that this year ballooned to more than $40 trillion.

Read More: Deutsche Bank’s ESG Probe Triggers Review at Asset Managers

The claims prompted probes by authorities in the US and Germany and, as a result, dragged down the firm’s share price. They also became a source of pressing questions during investor meetings and earnings calls, undermining Woehrmann’s efforts to highlight DWS’s growth.

DWS has consistently denied the allegations and repeated after the Tuesday raid that it stands by its public ESG disclosures. The firm has twice hired outside help to assess Fixler’s claims and in both cases decided that they’re unsubstantiated.

Deutsche Bank has shared the assessment. The belief that Woehrmann had done no wrong and DWS would ultimately be cleared in the probes was a key reason why Sewing held on to him for so long. After all, Woehrmann had been credited with stemming outflows at the asset manager and improving morale.

Woehrmann and Sewing have been close for several years. The Deutsche Bank CEO promoted Woehrmann in 2015 to help him turn around the lender’s German retail business and three years later asked him to take over the top post at DWS when Sewing sacked his predecessor, Nicolas Moreau.

But the clouds over the DWS CEO’s head darkened at the beginning of this year when it emerged that he had used his private email account for business purposes in a potential violation of industry rules.

He had previously also privately exchanged money with a businessman who was involved in negotiations Woehrmann was leading for Deutsche Bank on a deal, raising questions about his ability to keep private matters separate from professional ones. Woehrmann’s lawyers have said the money was for a car purchase that ultimately fell through.

Read More: German Prosecutors Review DWS CEO Woehrmann’s Role in Deals

Woehrmann increasingly saw the ESG allegations and the additional revelations as a smear campaign coordinated by Fixler and others, including current DWS employees. Around the same time, he also received threatening letters from anonymous senders, some of which contained racist insults. He was toying with the idea of quitting, he said in private talks at the time.

For their part, the leadership at Deutsche Bank including Sewing were getting frustrated with the constant barrage of negative headlines over DWS. They saw the legal and regulatory issues overshadowing the progress they were making with Sewing’s broader turnaround plan for the bank. Still, they decided they wouldn’t force Woehrmann to go if he managed to stay out of the news.

That mood began to shift gradually in the run-up to Deutsche Bank’s annual general meeting in May as investors raised concerns over the greenwashing claims. Proxy advisory firm Glass Lewis cited the matter as a key reason why it recommended that shareholders withhold approval of Deutsche Bank’s management at the event.

The belief among Deutsche Bank’s top leaders that Woehrmann had to go to draw a line under the matter and shield DWS from greater damage grew throughout the second half of May. The lender started succession planning with the intention to make an announcement just before the DWS AGM on June 9.

Read More: Deutsche Bank AGM Shouldn’t Absolve Leaders, Advisor Says

Management settled on corporate-bank head Hoops, an upcoming executive who is close to Sewing and has jumped in previously in delicate situations. His mandate will be to clean up at DWS, which potentially includes firing people.

When the raid hit, Sewing decided they couldn’t wait any longer and initiated the replacement plan. The talks with Woehrmann stretched into the night, ultimately triggering the early-morning notification.

While Woehrmann didn’t get to comment in the release, several of the lender’s top executives heaped praise on him, with Sewing thanking him “for his impressive work and performance for DWS and Deutsche Bank.”

DWS let him send a farewell message to staff.

“The allegations made against DWS and me over the past months, including personal attacks and threats, however unfounded or undefendable, have left a mark. They have been a burden for the firm, as well as for me and, most significantly, for those closest to me,” Woehrmann wrote in the memo. “It is with an extremely heavy heart that I have agreed with the firm to resign as CEO.“

(Updates with details on relationship between Woehrmann and Sewing in 13th paragraph)

©2022 Bloomberg L.P.