Aug 22, 2022

Egypt Nears Deal on New IMF Loan in Face of Economic Crisis

, Bloomberg News

(Bloomberg) -- Egypt is nearing an agreement with the International Monetary Fund on a new loan, its prime minister said, signaling more help for the economy may be imminent after a leadership shakeup at the central bank.

“The government is in the final-agreements stage regarding new financing from the IMF,” premier Mostafa Madbouly said Monday in a statement from his cabinet. There were no further details, including on how much Egypt might borrow.

An IMF deal has become key for the Arab world’s most populous nation as it grapples with higher food and fuel import bills. Foreign portfolio investors have pulled some $20 billion from the local debt market amid the conflict in Ukraine.

Egypt’s Gulf allies have stepped up to support the economy of a country seen as a regional linchpin, pledging more than $22 billion in deposits and investments. Leaders of the United Arab Emirates, Jordan, Bahrain and Iraq are in Egypt on Monday for a five-country Arab summit including talks on economic, investment and trade cooperation.

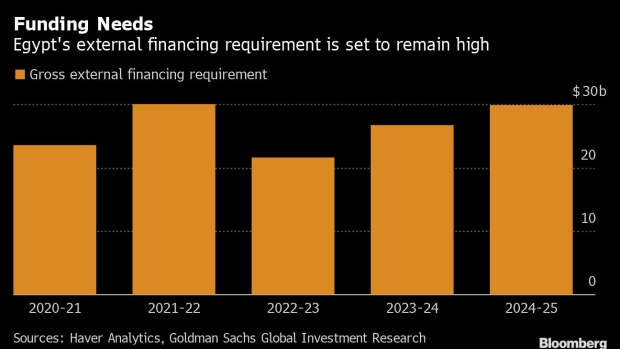

Egypt has been in talks for months with the Washington-based lender, with discussions centering on a so-called Extended Fund Facility and the necessity of a more flexible exchange rate for the pound. Pressure is mounting on the currency even after it was devalued by about 15% in March, with economists and analysts saying it needs to fall further to reduce Egypt’s funding gap.

Read More: Currency Standoff in Egypt Deepens as Investors Urge Devaluation

Goldman Sachs Group Inc. estimates Egypt may need to secure a $15 billion package from the IMF to meet its funding requirements over the next three years, though the government is asking for a smaller amount.

The past week has seen change at the top of Egypt’s central bank. Governor Tarek Amer, who’d been in the role for about seven years and was seen as supportive of a stable pound, resigned a day before an interest-rate meeting. Veteran financier Hassan Abdalla has been named acting chief.

Read More: Currency Cure by Stealth Has Egypt Sweating It Out Months Later

Egyptian Supply Minister Aly El-Moselhy on Monday told reporters the country is leaving bread subsidies unchanged for now, saying the time wasn’t right to take action. Authorities had previously vowed to reduce spending on the costly system that provides the staple foodstuff to an estimated 70% of the country’s 100-million-plus population.

Egypt agreed a three-year IMF program in late 2016 that involved a currency devaluation, sweeping reforms and a $12 billion loan. The moves helped rekindle investor interest in the economy battered by the 2011 uprising that ousted long-time President Hosni Mubarak and its aftermath.

In 2020, Egypt secured a $5.2 billion stand-by arrangement as well as $2.8 billion under the IMF’s Rapid Financing Instrument aimed at helping authorities tackle the impact of the coronavirus.

©2022 Bloomberg L.P.