Jul 21, 2022

European gas prices fall as Nord Stream brings relief

, Bloomberg News

The E.U. won't have enough gas to get through the winter without rationing: Strategist

European natural gas prices rose, with traders watching for whether Russian shipments via the Nord Stream pipeline will change over the coming days.

Gas was flowing to Germany at about 40 per cent of the pipeline’s capacity, after the link returned from 10-days of scheduled maintenance on Thursday. That’s roughly the same volume prior to the works.

The resumption eased initial fears that Moscow would halt shipments altogether -- and it provides some relief for Europe as it races to store the fuel before the winter. But officials and businesses are now guessing about what comes next.

“It remains to be seen whether gas will actually flow in the long term and in the amount contractually agreed,” said Siegfried Russwurm, president of German business lobby BDI. “The limited delivery quantities mean high prices and are unsettling for industrial and private consumers.”

European Union policy makers have been preparing for the worst, with a plan to curb gas consumption by 15 per cent. Germany raised its target to fill gas storage to 95 per cent by Nov. 1, from a previous goal of 90 per cent. The move reflects growing concern about the country’s ability to have ample winter supplies.

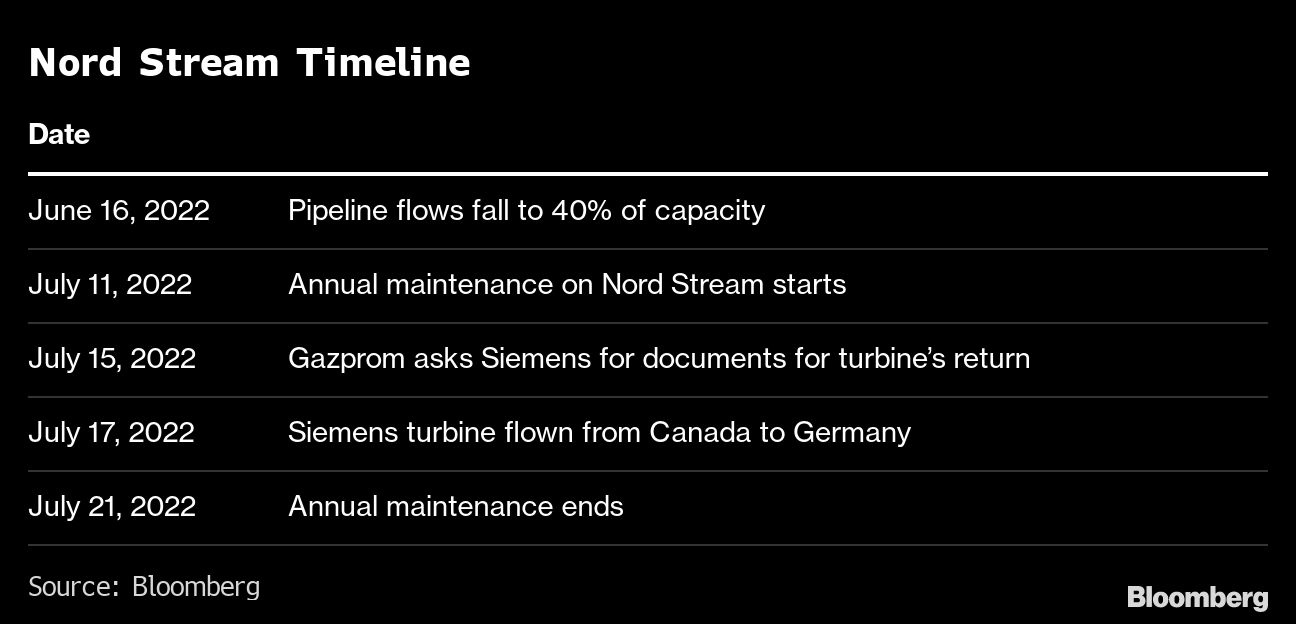

Traders have been looking for clarity on plans to restart the pipeline for days. Russian President Vladimir Putin on Tuesday warned that Nord Stream could return from maintenance at lower rates unless a spat over a key piece of equipment is resolved. One of the pipeline’s turbines got stuck in Canada by western sanctions on Russia for its invasion of Ukraine, but has since been released.

Putin said delays in receiving the turbine could lead volumes being cut to 20 per cent of capacity by the end of this month, when another part is due for maintenance. Flows via the pipeline were reduced to around 40 per cent of capacity on June 16 until the annual works started.

Europe needs to stay vigilant despite returning flows via Nord Stream, said Simone Tagliapietra, a senior fellow at Brussels-based think tank Bruegel. For Moscow, keeping flows low may be a better strategy than cutting them off altogether, he said.

“It decreases Europe’s resolve to reduce gas demand,” he said. “An interruption is likely to happen in the winter and each cubic meter of gas saved now, makes Europe more resilient in the next months.”

In a call with reporters on Thursday, Kremlin spokesman Dmitry Peskov rejected accusations that Russia uses gas to pressure or blackmail Europe.

Dutch front-month futures rose 1.1 per cent to 156.70 euros per megawatt-hour by 5:46 p.m. in Amsterdam. The European benchmark earlier slumped as much as 6.5 per cent.