Mar 26, 2024

European Stocks Are Heading for a Second Quarter of Gains

, Bloomberg News

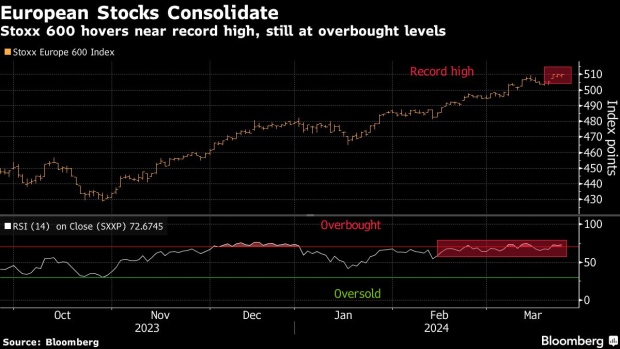

(Bloomberg) -- European stocks rose to a fresh record and were set for a second quarter of gains as investors bet on potential rate cuts.

The Stoxx Europe 600 was up 0.3% by the close in London. BNP Paribas SA gained as Goldman Sachs analysts upgraded the lender to buy from neutral. Retail and banking stocks outperformed, while miners lagged amid deepening anxiety over Chinese demand for iron ore.

Among individual movers, Umicore SA fell after Goldman Sachs assumed coverage of the chemicals company with a sell rating. Ocado Group Plc jumped as its online grocery business saw higher sales after it cut prices to attract British shoppers during the cost-of-living crisis.

European stocks have rallied this year amid bets on resilient global growth and the prospect of central bank rate cuts. There are now signs that regional stocks are becoming more attractive versus their US peers as a rally in technology stocks has led to surging valuations across the Atlantic. Data from Citigroup Inc. showed investor risk appetite appears to be stronger in Europe, with all markets showing increased bullish flows.

Still, the possibility of a consolidation is growing with the Stoxx 600 hovering around record highs. The benchmark index continues to flash an overbought signal — generally considered to be a precursor to a selloff.

“As we head into the long weekend, investors might not want to make any aggressive moves and just wait to see new data come out,” said Richard Flax, chief investment officer at European digital wealth manager Moneyfarm. More broadly, there’s “some level of concern that inflation is not on a completely smooth trajectory towards the 2% target. And there are still some residual questions about how resilient earnings will prove to be going forward.”

For more on equity markets:

- Just One Warning Doesn’t Spell Doom for All Luxury: Taking Stock

- M&A Watch Europe: Telefonica, Cellnex, Edenred, Repsol, Casino

- Reddit, Galderma Debuts Raise Hopes for IPO Revival: ECM Watch

- US Stock Futures Little Changed; Reddit, Inari Medical Gain

- Is Britain Good for Business?: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.

©2024 Bloomberg L.P.