Apr 2, 2024

French Power Prices Tumble With Demand Set to Drop Even Further

, Bloomberg News

(Bloomberg) -- French power prices slumped as consumption is set to drop further and the nation’s nuclear fleet has largely recovered from operational issues that kept many reactors offline in the past few years.

Front-month futures dropped as much as 24%, the most in more than a year. The contract is now trading at about half the price of that in Germany, Europe’s biggest market and a benchmark for the region.

A mild winter has caused energy consumption throughout Europe to remain subdued after the energy crisis curbed industrial demand. The drop in prices in France is more pronounced because the slump in usage has coincided with a better performance from its atomic plants after years of extended outages amid lengthy checks and repairs.

Supplies in France look comfortable with the “length in the market really robust moving into summer,” said Daniel Muir, an analyst at S&P Global Commodity Insights in London. High gas stocks are also a cushion against a potential increase in Asian demand for liquefied natural gas, he said. Higher gas prices may also drive up power.

France’s nuclear reactor availability rose from last week, with Tricastin-1 and Blayais-2 resuming output over the weekend. This means there are currently 40 reactors available out of a total 56 units.

Read: French Nuclear Reactor Availability Rises During Weekend

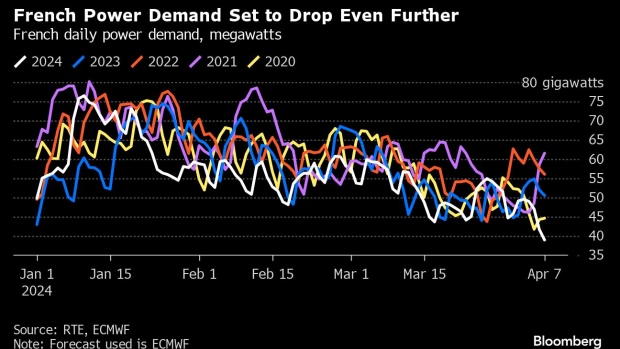

Demand in France is forecast to drop below 40 gigawatts in the coming days, according to a Bloomberg model. That’s a level normally seen in May, according to grid data, but milder-than-average weather is set to curb seasonal demand a month earlier this year.

French month-ahead power declined 24% to €23.16 per megawatt-hour by 4:08 p.m. in Paris. In Germany, the equivalent contract slid 8.7% to €49.70 per megawatt-hour.

©2024 Bloomberg L.P.