Jul 13, 2022

Goldman Says UN’s Green Roadmap Can Help Investors Assess China

, Bloomberg News

(Bloomberg) -- Investors looking to assess the green credentials of Chinese companies can use the United Nations’ Sustainable Development Goals as a benchmark until China comes up with clearer rules of its own, according to Goldman Sachs Group Inc.

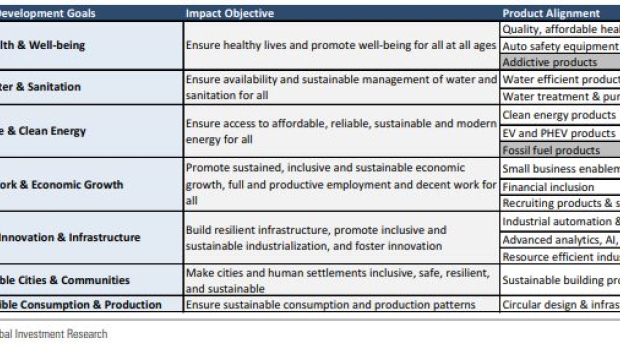

China’s broad objectives under its “common prosperity” strategy to address social and economic inequality overlap with seven investable development goals, the Wall Street giant found in a research report.

“In the absence of clear criteria or standardized data to assess corporate exposure to Common Prosperity, our UN SDG framework provides a robust starting point for stock selection,” analysts including Sharmini Chetwode wrote.

President Xi Jinping’s common prosperity program, revived in a 2020 speech, has become a national priority in the past year and is seen to weigh on businesses that exacerbate the country’s wealth divide. Still, there’s a lack of uniform guidelines on how companies are supposed to meet the objectives.

Good health, clean water and energy and sustainable cities are among the UN goals that match up with the Chinese socio-economic program, the brokerage said. It has identified 51 stocks, most of which have “revenue alignment” of more than 25% to at least one of the seven sustainable goals.

These include stocks that are fully-aligned such as Jiangsu Hengrui Medicine Co. and Zhuzhou CRRC Times Electric Co. as well as some that satisfy social objectives but appear mis-aligned, such as Muyuan Foods Co.

The UN goals “have emerged as a common language for understanding how companies and portfolios are positioned for environmental and social impact and are increasingly used by investors to classify impact,” the Goldman Sachs analysts wrote.

©2022 Bloomberg L.P.