Oct 21, 2022

Goldman Strategists Warn Credit Is Downplaying Recession Risk

, Bloomberg News

(Bloomberg) -- Goldman Sachs Group Inc. strategists joined a growing chorus warning that credit markets need to do more to price in recession risks.

Risks are “largely skewed to the wider side” for Goldman’s spread forecasts in 2023, credit strategists including Lotfi Karoui wrote in a report Oct. 20. This means that credit, which fell into a bear market in 2022, may be headed for further pain.

The New York-based bank added its voice to calls from PGIM and JPMorgan Asset Management flagging the upward risks to yield premiums in credit as the chances of recession in the US mount. Current spreads indicate that investors are still “complacent,” JPMorgan Asset’s Kelsey Berro said in an interview on Bloomberg Television this week.

“While the last four decades have seen credit spreads justifiably shrug off rising recessionary fears, we think the current episode is different,” the Goldman strategists said. “Higher policy rates and real yields will continue to bolster the value proposition of cash, pushing the credit risk premium higher.”

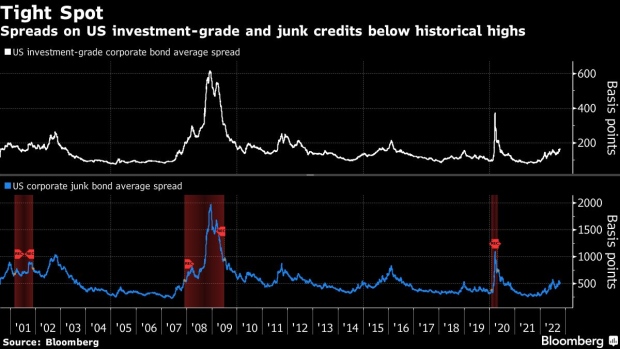

Goldman expects US investment-grade spreads to widen to 175 basis by year-end, and for junk yield premiums to climb to 625 basis points. They may then tighten in the first half of 2023, it said.

Bloomberg indexes show that high-grade US yield premiums are currently at 163 basis points, just below their year-to-date high touched this month. Junk spreads are at 500 basis points, well below their high reached in July.

There is a possibility, however, that “the rebuild of risk premium is likely to extend into the next few quarters,” the strategists wrote in the report.

The latest US recession probability models by Bloomberg economists show a higher probability of contraction across all time frames, with the 12-month estimate of a downturn by October 2023 hitting 100%.

©2022 Bloomberg L.P.