May 16, 2022

Grayscale Makes Europe Debut with Crypto ETF

, Bloomberg News

(Bloomberg) -- Grayscale Investment LLC, the operator of the world’s biggest crypto fund, is making its European debut with an exchange-traded fund tracking a basket of digital asset companies, rather than a product tied to the price of Bitcoin itself.

The fund manager will launch its Future of Finance UCITS ETF (ticker GFOF) on the London Stock Exchange, Borsa Italiana and Deutsche Börse Xetra on Monday, in collaboration with white-label ETF platform HANetf.

First launched in the US in February, GFOF tracks the investment performance of the $443 billion Bloomberg Grayscale Future of Finance index, with constituents including Robinhood Markets Inc, Block Inc and Coinbase Global Inc.

Grayscale is currently lobbying US regulators for permission to convert its $19 billion Bitcoin Trust (ticker GBTC) into an ETF that would directly track the price of Bitcoin. Spot Bitcoin ETFs have yet to be approved in the US.

- Read more: Wonky SEC Ruling Reignites Spot US Bitcoin ETF Approval Debate

The firm enters a competitive market in Europe, where spot crypto exchange-traded products from rivals including CoinShares International Ltd and 21Shares AG having been available on local bourses for several years.

Michael Sonnenshein, chief executive of Grayscale, told Bloomberg in an interview that while the firm has “high conviction in investors wanting to have digital asset exposure”, it viewed the Future of Finance ETF as the “most liquid way” for traders to share in that value.

“What we’re finding is that many people equate the ability to invest in an entirely new category of thematic investing as to what they might have experienced had they begun investing in cloud computing or other categories a decade ago,” Sonnenshein said. “Those would have been the proverbial nets that would have captured opportunity.”

- Read more: Grayscale to Expand Into Europe’s Competitive Crypto-Fund Market

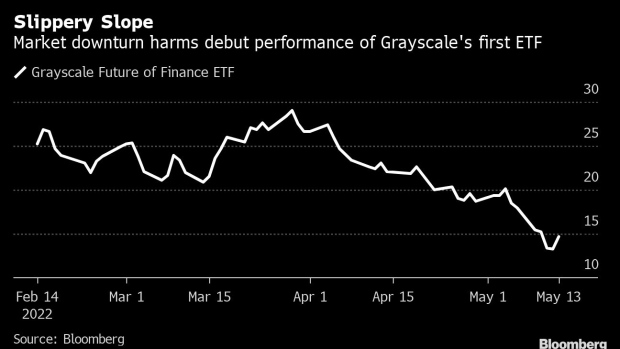

The performance of both Grayscale’s Bitcoin Trust and its Future of Finance ETF have suffered in recent months as the broader crypto market swung between periods of sideways trading and extreme volatility.

GBTC shares hit a record discount to the price of Bitcoin on Tuesday following a meeting with the Securities and Exchange Commission about its ETF application, according to data compiled by Bloomberg, while the US-listed GFOF ETF recorded a three-month return of -42.6% as of May 13.

Bloomberg revealed last month that Grayscale planned to run a series of pilot tests across the continent. Sonnenshein declined to comment on whether the firm might launch spot crypto products in Europe in future, saying that conversations with partners to date had focused on an equities launch.

“It’s important to take a larger step back away from performance over the last couple weeks and months,” said Sonnenshein, adding that thematic investing is a relatively new area for the European crypto market.

“What we’re seeing and hearing is about the growing popularity about ETFs in Europe, not only significant interest in thematic investing but also in crypto-related products as well as ESG. Many investors are beginning to gravitate toward the familiarity and protection that the ETF wrapper offers,” he said.

Read more: Crypto ETPs Enjoy Growth Spurt Even as Digital Assets Plunge

©2022 Bloomberg L.P.