Jan 29, 2019

Harley-Davidson profit is wiped out by Trump's tariffs

, Bloomberg News

Harley-Davidson Inc. (HOG.N) barely broke even in the last quarter of a year in which the struggling American icon got caught up in President Donald Trump’s trade wars. The motorcycle maker’s shares plunged the most in a year.

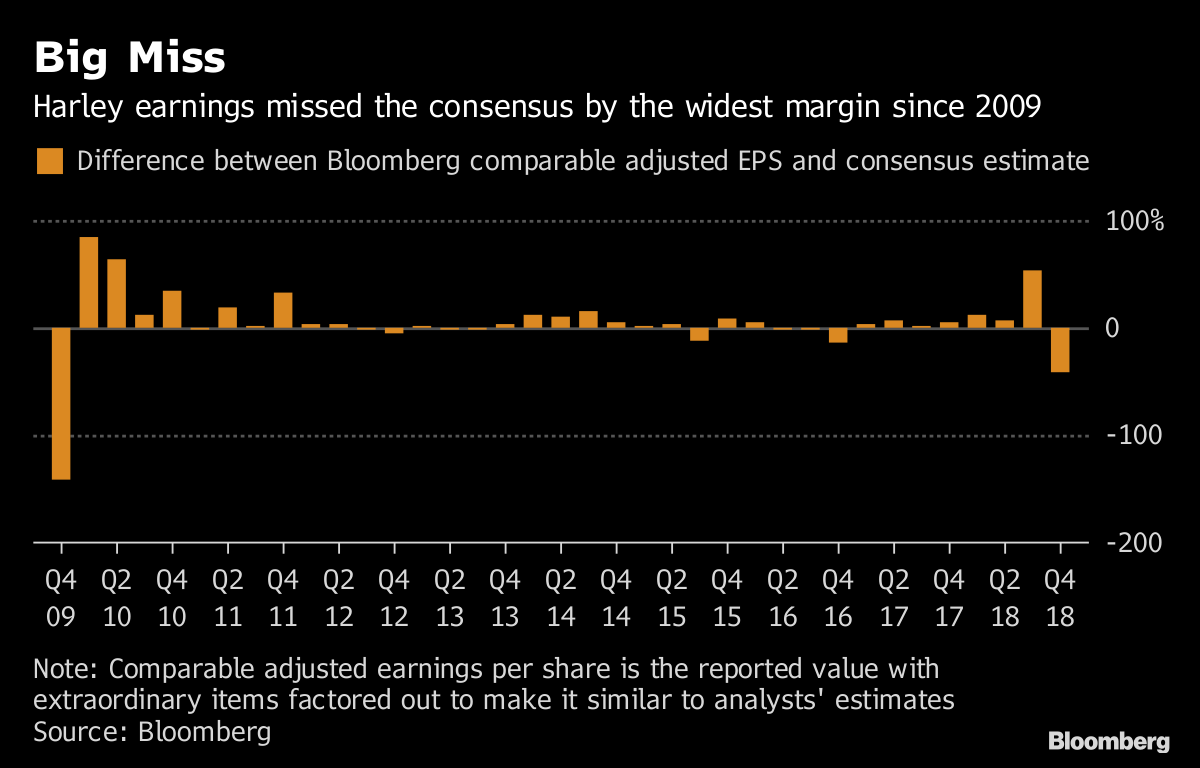

Earnings per share on a GAAP basis were zero in the fourth quarter, the Milwaukee-based manufacturer said in a statement Tuesday. Excluding restructuring and tariff costs, profit was 17 cents a share, missing analysts’ average estimate for 29 cents.

Trump attacked Harley last year after it announced plans to shift some U.S. production overseas to sidestep levies imposed by the European Union. But the motorcycle maker has more than tariffs and angry tweets to blame for its performance. U.S. retail sales tumbled 10 per cent in the three months ended in December, the eighth consecutive quarterly drop. Chief Executive Officer Matt Levatich is having trouble attracting younger riders and plans to offer cheaper bikes and sell more clothing and gear -- including on Amazon -- to reach new customers.

“2019 we expect to be another difficult year until major initiatives like More Roads start kicking in,” Levatich said in an interview, referring to a turnaround plan unveiled last year. “Everything is angled at that core issue of building riders in the U.S. and leveraging growth opportunities we have in the near term and internationally.”

Harley shares fell as much as 9.5 per cent -- the biggest intraday drop since Jan. 30 -- and were down 7.6 per cent to $33.83 as of 9:48 a.m. in New York. The stock plunged 33 per cent last year.

Expanding Overseas

Retail demand dropped in Europe and Asia, sending worldwide sales down 6.7 per cent last quarter. Levatich’s plans call for half of sales to come from outside the U.S. by 2027, up from about 42 per cent last year.

Harley has been investing to expand a new plant in Thailand to boost exports and produce the majority of motorcycles sold in the EU and China by the end of this year, Levatich said in the interview. The company hadn’t previously specified where U.S. production would be shifted to avoid tariffs the EU implemented in retaliation for higher levies on steel and aluminum.

Trump said in August that he’d back a boycott of the company’s bikes for moving production out of America. Tariff costs of US$100 million to US$120 million this year will be eliminated in 2020, once the Thailand plant expansion is completed, executives said on an earnings call.

What Our Analysts Say...

The energy Harley-Davidson is expending to spur U.S. sales of heavyweight motorcycles outside its rigid demographic may be better spent attracting foreign riders to the iconic American brand.-- Kevin Tynan, Bloomberg Intelligence auto analystClick here to view research reportLevatich is introducing as many as five electric models, including lightweight, urban bikes to target growth in Europe and India. Analysts think demand for Harley’s first electric model, called LiveWire, will be limited because of its US$29,799 price tag.

For 2019, Harley plans to ship between 217,000 and 220,000 motorcycles. The midpoint of that forecast would be the lowest shipments for the company since 2010.