Dec 15, 2023

Hedge Funds’ Bearish Yen Bets Lose Again After Fed Signals Pivot

, Bloomberg News

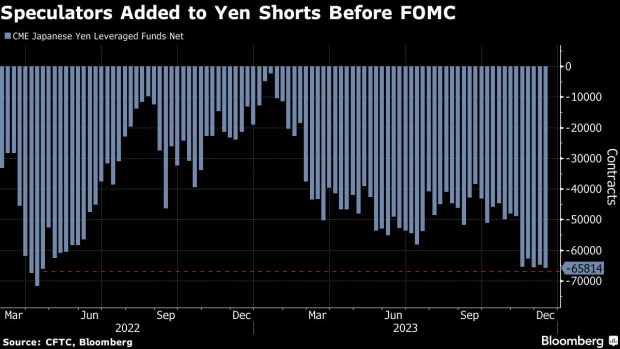

(Bloomberg) -- Just before the Federal Reserve gave its clearest signal yet that interest-rate cuts are coming, leveraged funds yet again boosted bearish bets on the yen — and paid dearly in the process.

Speculators increased their net short position on the yen by 973 contracts to 65,814 total in the week ended Dec. 12, according to data released Friday by the Commodity Futures Trading Commission. That’s the biggest net short position in the yen among leveraged funds since April 2022.

The data reflects activity in the days just ahead of the Fed’s final rate decision of the year, in which policymakers forecasted a series of cuts next year. The projection prompted a plunge in the dollar against Group-of-10 peers, including the yen.

The yen is up nearly 2% against the dollar over the past five days for its best weekly performance since July.

Read more: Hedge Funds Held Big Bet Against Yen in Days Before Its Surge

While leveraged funds specifically added to bearish yen positions, the CFTC’s net non-commercial data overall — which accounts for other market players, like asset managers — showed a paring of such trades.

The data comes as traders await the conclusion of the Bank of Japan’s own two-day policy meeting on Tuesday.

What Bloomberg Economics Says:

“Some investors saw recent comments by Bank of Japan officials, broaching the topic of exit scenarios, as a signal of an imminent move away from yield curve control. This is likely a mistake. We see the messaging as part of a long process of laying the groundwork for a smooth transition next year, most likely in July.”

- Taro Kimura, Contributing Analyst

For the full note, click here.

Most economists broadly expect the central bank to leave its short—term rate steady at -0.1% and the target on 10-year Japanese government bond yields at 0% with a 1% upper limit.

However, recent chatter from policymakers in Japan has left traders on edge, and the yen has gained more than 4% this December.

The CFTC report also showed leveraged funds trimmed their net short positions on the euro, while boosting long sterling bets.

- Leveraged funds adjusted net positions as follows:

- Increased net JPY short by 973 contracts to 65,814

- Decreased net EUR short by 313 contracts to 10,092

- Raised net GBP long by 1,370 contracts to 14,095

- Decreased net AUD short by 6,956 contracts to 1,626

- Trimmed net NZD short by 1,203 contracts to 7,300

- Raised net CAD short by 1,854 contracts to 37,707

- Added net CHF short by 569 contracts to 3,244

- Lowered net MXN long by 1,341 contracts to 23,577

- Asset managers changed net positions as follows:

- Reduced net JPY short by 15,007 contracts to 3,071

- Decreased net EUR long by 21,542 contracts to 381,066

- Raised net GBP short by 6,509 contracts to 33,480

- Added net AUD short by 2,508 contracts to 74,013

- Trimmed net NZD short by 4,989 contracts to 12,079

- Raised net CAD short by 32 contracts to 49,180

- Reduced net CHF short by 3,801 contracts to 7,257

- Increased net MXN long by 3,318 contracts to 133,935

--With assistance from Anya Andrianova.

©2023 Bloomberg L.P.