Apr 3, 2023

Hong Kong Intervenes in FX Market For First Time in Seven Weeks

, Bloomberg News

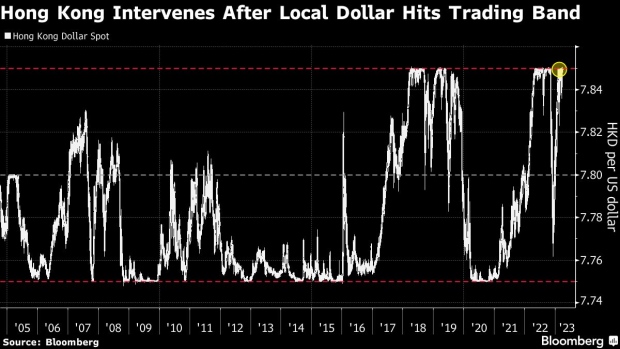

(Bloomberg) -- The Hong Kong Monetary Authority intervened to prop up the local dollar for the first time since February as carry trades against the currency push it past the weak end of its trading band.

The HKMA bought HK$7.1 billion ($905 million) worth of the city’s dollars on Monday, shrinking the city aggregate balance, a measure of interbank liquidity, to HK$69.9 billion. Standard Chartered Bank Plc. and DBS Bank expect that gauge to bottom out at around HK$54 billion.

The Hong Kong dollar remains under selling pressure as the city’s interbank rates linger below those in the US, prompting hedge funds to borrow the local currency cheaply and sell it against the higher-yielding greenback. That’s even as HKMA interventions aimed at pushing up local rates have shrunk the aggregate balance by more than 80% from its peak in 2021.

“Given negative HKD-USD rate spreads and as hefty inflows are yet to come, further intervention is still likely,” said Frances Cheung, rates strategist at Oversea-Chinese Banking Corp. in Singapore. “The comfortable zone” for the aggregate balance may be HK$40 billion to HK$70 billion, she added.

The last time the city’s de-facto central bank intervened was on Feb. 14 in New York when the Hong Kong dollar crossed the weak end of its 7.75-7.85 per dollar trading range.

Rates Risk

However, analysts warn that further drainage of Hong Kong dollar liquidity would worsen the volatility in the rates market. The overnight Hong Kong interbank offered rate, known as Hibor, jumped the most in at least 17 years on March 21 before easing the following day.

“This could lead to higher Hibor volatility in the short-term, as banks have less buffer to handle any big swing in daily needs and possible external shocks,” said Kelvin Lau, senior economist at Standard Chartered Bank in Hong Kong. “But even with such higher volatility, so long as Hibor continues to trade materially below its USD counterpart, FX carry is likely to keep USD/HKD near the top end of the band,” he added.

Looking forward, carry trade players have become increasingly cautious and further declines in aggregate balance should be “slow and moderate,” said Carie Li, global market strategist at DBS Bank in Hong Kong. “However, we don’t think aggregate balance will bottom out before the Federal Reserve ends the rate hike cycle.”

Carry Trade Drives Hong Kong Dollar Near Weak End of Band (2)

--With assistance from Michael G. Wilson.

(Updates throughout.)

©2023 Bloomberg L.P.