Jul 27, 2022

Inflation Reckoning Arrives for Turkey While Credibility Is Shot

, Bloomberg News

(Bloomberg) -- Turkey’s central bank is set to raise its projections for consumer prices after doing little in the face of a worsening inflation crisis that’s left the country with the world’s deepest negative real interests rates.

Once a can’t-miss event on the central bank’s calendar, the quarterly unveiling of its inflation report has faded in prominence among investors, with rates expected to stay on hold in the months to come. Even as price growth nears triple digits, policy makers haven’t raised borrowing costs since a round of monetary easing in late 2021, pushing Turkey’s key rate to almost 65% below zero when adjusted for prices.

On Thursday, Governor Sahap Kavcioglu is again poised to amend the bank’s base-case scenario for consumer prices through the rest of 2022 as well as for the next two years, and then take questions from economists and reporters in the Turkish capital, Ankara.

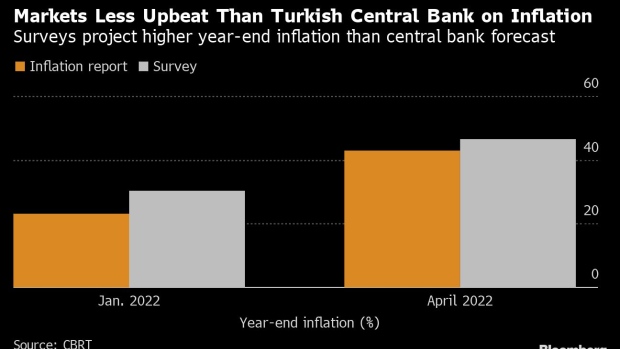

Previous projections from April showed inflation will end the year at 42.8%, with Kavcioglu blaming the global commodity rally but saying price growth could start slowing as early as June. Instead, it’s accelerated every month this year, made worse by a steep depreciation in the lira.

“The central bank will emphasize that inflationary pressures come from energy and commodities and the retreat in both will lessen the pressure,” said Burak Arzova, finance professor at Marmara University in Istanbul.

Turkey Clings to World’s Most Negative Real Rates With Pause

Central bankers around the world are unleashing the most aggressive tightening of monetary policy in decades after taking the blame for responding too slowly to rising prices.

By contrast, Kavcioglu has the backing of President Recep Tayyip Erdogan, a self-styled enemy of high borrowing costs who believes -- contrary to mainstream economics -- that rate hikes cause inflation.

Annual inflation in Turkey has meanwhile approached an annual 79% in June, running more than 15 times higher than the official target. Erdogan said this month that he expects a “marked” slowdown in prices from around February or March next year.

What Bloomberg Economics Say...

“We expect the year-end inflation rate to be revised up, likely to a lower rate than our estimate of 69%. The president signaled that the disinflationary process will begin in February-March next year. Without an active monetary policy prioritizing price stability, this relies on dissipating external factors.”

--Selva Bahar Baziki, Turkey economist. For more, click here

In place of higher rates, authorities have instead relied on less direct measures, focusing on curbing commercial loan growth as well as policies aimed at widening the use of the local currency and channeling capital toward long-term investment.

The measures have done little to protect the lira, the worst performer in emerging markets so far this year after losing more than a quarter of its value against the dollar.

Turkey, a major importer of grain and energy, was especially vulnerable to the global run-up in commodities costs after the Russian invasion of Ukraine in February. Food and energy were among the main drivers of consumer prices last month.

“Lira depreciation, supply constraints, increases in import prices and high levels of inflation expectations continue to pose risks to the inflation outlook,” Yapi Kredi Invest analysts said in a report this week.

©2022 Bloomberg L.P.