Sep 11, 2022

Inflation to Tamp Down Fertilizer Use in Top Importer Brazil

, Bloomberg News

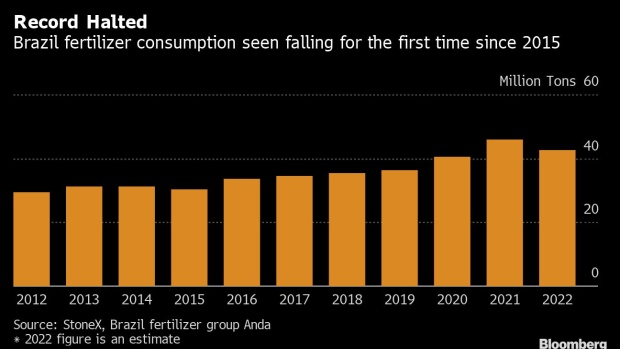

(Bloomberg) -- Fertilizer demand in top importer Brazil is expected to fall for the first time in eight years, boosting weather risk for corn and the world’s biggest soy harvest.

Brazilian farmers will probably consume 7.2% less fertilizers in 2022 due to higher costs, according to an estimate from StoneX. Producers will take advantage of nutrients that remained in soil from previous seasons, especially phosphorus and potassium.

“With favorable weather and the absence of plagues and diseases, less fertilizer should not hurt yields,” Luigi Bezzon, an analyst at StoneX in Sao Paulo, said in a telephone interview. “But crops will be more susceptible to weather conditions.”

Declining fertilizer use in the planting season starting next week is another concern for growers and buyers who are already closely monitoring rains patterns amid a third consecutive La Nina, which usually boosts dryness in south Brazil. In 2021-22, the phenomenon caused the nation’s soybean output to drop by 10%.

As demand slackens, Brazilian storage depots are brimming with crop nutrients following a period of record imports. In Paranagua, private warehouses are at 90% of their maximum storage capacity, according to Luiz Teixeira da Silva, operations director at the port. In Santos, over 60% of the main terminal for fertilizers is full.

Almost 5 million metric tons of fertilizer are expected to arrive through December, according to Alphamar, an agricultural shipping agency, focused in Brazilian Agribusiness. Despite the surplus, prices have not fallen enough to spur more purchases from farmers since grains are off the highs seen in May and June. Fertilizer suppliers are reluctant to cut prices given they purchased much of the product as prices surged to avoid shortages after Russia’s invasion of Ukraine sparked global bottlenecks.

Some are concerned the concentration of product in the ports could cause some bottlenecks to deliveries inland for the next plantings, including the winter-corn crop in March, according to agriculture consultant Diogo Mazotini.

However, fertilizer flow to farms from the main port of Paraguana will speed up along with rising corn exports in the coming months --companies usually use the same trucks that carry grains to ports in return trips to the interior, said da Silva.

©2022 Bloomberg L.P.