Nov 24, 2020

Inside Bloomberg’s Covid Resilience Ranking

, Bloomberg News

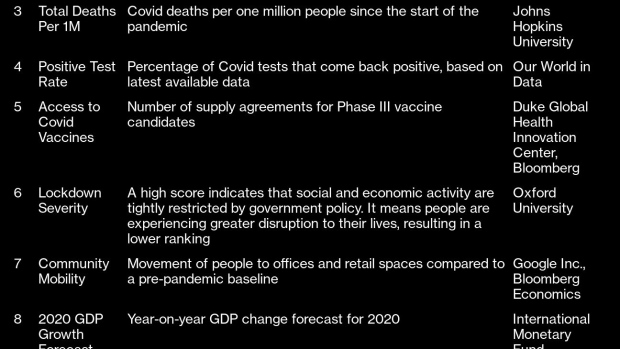

(Bloomberg) -- Everyone is fighting the same coronavirus, but nearly a year into the pandemic, quality of life and control of the pathogen’s spread look vastly different across the world. Bloomberg’s Covid Resilience Ranking scores the largest 53 economies on their success at containing the virus with the least amount of social and economic disruption.

We considered many datasets, indicators and indexes produced by organizations around the globe and applied three fundamental criteria in whittling the list down to the 10 components that make up our Ranking:

- How complete is the data?

- Many relevant indexes and databases -- for instance, measures on trust in government -- cover only a small number of places. We focused on indicators that cover the vast majority of the 53 economies covered in the Ranking, filling in the gaps with substitutions where reasonable.

- How current is the data?

- All datasets have a lag, some of up to a few years. Because of the pandemic’s pace and transformational impact, we chose to use the most up-to-date datasets where possible, with the maximum lag one year. Seven of our indicators are updated daily, one is refreshed quarterly, and two are annual figures.

- Who collects the data?

- We decided to only use indicators from reputable third-party organizations with a track record of data collection and analysis.

Why only rank 53 economies?

We decided for brevity and relevance to limit the Ranking to economies valued at more than $200 billion.

How is the Ranking aggregated?

Each of the 10 data indicators are aggregated through the “max-min” method, which is used to convert metrics expressed in different scales into a common one, while maintaining the relative distance between values.

All the indicators are scored on a 0-100 scale, with 100 (blue) indicating the best performance and zero (orange) the worst. The rest fall in between, scaled by their distance from one another. The final Ranking score is the average of a place’s performance across the 10 indicators, equally weighted.

Bloomberg will update the Ranking regularly as the data shifts and circumstances change.

Can Covid-19 data be trusted?

Under-detection, under-reporting and manipulation of virus data on cases and deaths have been a recurring issue across many economies during the pandemic.

In most places, gaps in the data are largely due to the chaotic and fast-moving nature of the crisis: the supply of test kits has been inadequate, leading to under-detection of cases. Official death tolls are also likely to be under-reported due to people dying at home before being diagnosed, lags in reporting from overwhelmed hospitals and Covid-19 deaths being recorded in some places as due to other causes.

Countries like Spain, the U.S. and China have adjusted their numbers throughout the pandemic, and credible reports have emerged that some nations, including Iran, Brazil and Russia, have intentionally concealed or downplayed data. Beyond that, excess mortality in some economies this year -- the additional number of deaths overall compared to previous years -- has outstripped official Covid-19 death tolls.

Still, given that it’s hard to distinguish between slow reporting, inadequate resourcing and the intentional concealment of data, we’re using cases and deaths data compiled by Johns Hopkins University, which draws largely from government sources, with the awareness that this is likely not the full picture.

A note on China’s numbers, which have been called into question by the U.S. and others. Throughout the pandemic, the country has repeatedly adjusted its virus data, adding nearly 15,000 new cases in one day in mid-February and raising its overall death toll by 40% to 4,632 in April. These revisions arguably make its latest numbers more reliable. Researchers have used fraud detection techniques to conclude that, while China did manipulate its data in the early stages of the pandemic, its numbers have been accurate since.

Why do you have two datapoints on virus deaths?

The trailing one-month case-fatality rate is a good indicator of whether a place is effectively treating infected people and preventing Covid-19 deaths, a fundamental aspect of containing the virus. Over time, this ratio has rapidly improved among mostly developed economies as doctors and hospitals learned how to better fight the coronavirus.

The rate also captures the point economies are at on their individual pandemic curves. Australia had a high case-fatality rate during a brutal southern hemisphere winter wave that triggered a three-month lockdown in the country’s Victoria state. As of November, with that outbreak largely quelled, the rate has fallen to a relatively low level. Correspondingly, the case-fatality ratios for nations in the northern hemisphere have started to deteriorate as they enter the cold season.

The one-month case-fatality rate doesn’t, however, capture the scar that the pandemic leaves on an economy as a whole, especially in places like Belgium, Sweden, Italy, the U.K. and the U.S., where Covid-19 cut a swathe through elderly populations in its initial phase in the spring. A higher percentage of Sweden’s population died from the virus than Vietnam’s, even if Sweden’s ability to save the lives of Covid-19 patients has since improved. This is why we’ve also included an indicator that reflects cumulative Covid-19 deaths as a share of the total population: Total Deaths Per 1 Million.

Economies with older demographics generally rank lower on this measure, given the way the virus ripped through aged-care homes in its first wave. In Belgium, officials decided to classify every nursing home death as being from Covid-19, even if the patient wasn’t officially diagnosed before they died. This approach has made Belgium the bottom-ranked economy on overall mortality despite a relatively high score in its one-month case-fatality ratio.

What does the Positive Test Rate show?

The positive test rate is considered by experts as the most reliable way to determine if a place is testing enough.

A high rate of virus tests coming back positive indicates authorities are probably only testing the sickest patients who seek out medical attention and are not casting a wide enough net. It’s a sign there is likely to be undetected infections in the community. World Health Organization guidance is that governments should wait for the positive test rate to fall below 5% for at least 14 days before relaxing social distancing measures.

For economies that don’t report daily positive test rates, we derived their rates by dividing the number of cases over total tests administered on the last date that data was disclosed. We did this for China, Hong Kong, Thailand, Vietnam and the Netherlands. The correlation between an economy’s daily positive test rates and this measure is high, giving us confidence to substitute these values.

For Brazil, Colombia and Peru, reported testing data includes antibody tests, which provider Our World in Data doesn’t consider an appropriate comparison to other countries’ testing data (which typically exclude antibody tests). Our World in Data also doesn’t collate figures for Egypt and Argentina. These five nations, therefore, don’t have scores for this indicator in Bloomberg’s Ranking.

One caveat on this dataset is that some places report the total number of people tested, while some report the total number of tests. The possibility of multiple tests being administered to the same person in a single day could mean they’re not exactly apples-to-apples, but these differences are not significant in scenarios where millions of tests are being conducted daily.

What are you measuring with the Access to Covid Vaccines indicator?

While there are no approved vaccines against the virus right now, a number of developers are in the final stages of testing, with some shots already showing extraordinary efficacy, according to latest data. With a vaccine seen as the silver bullet that could end the pandemic, securing supply is an important component of an economy’s Covid-19 response.

Some places, like the U.S., have stated openly that their strategy is not to necessarily contain the virus’s spread, but to use vaccines and treatments to eventually quash it. Given widespread access to a viable vaccine could lead to a quick neutralization of cases and drop in deaths, we decided to include it as part of the Ranking. Consequently it has bolstered some places where the virus is effectively running rampant -- i.e., the U.S., home to the world’s biggest outbreak and highest death toll.

According to a WHO list updated every two weeks, there are currently 11 Covid-19 vaccines in Phase III testing, the final stage before regulatory approval. Bloomberg used a database of vaccine supply agreements compiled by Duke Global Health Innovation Center, supplementing it with our own research, to produce the Access to Covid Vaccines indicator.

The measure tracks how many supply deals an economy has signed with Phase III vaccine candidates. It’s based on public information and includes advance market commitments, letters of intent, as well as manufacturing agreements that specify that some supply will stay in the manufacturing location. Agreements to host clinical trials are not included unless it’s specified that the place in question will receive vaccine supplies after the trials.

We decided to track the number of agreements -- not doses -- because many of the deals announced don’t disclose order size. Some vaccine candidates may also require two jabs to be effective, meaning any orders will technically only cover half the number of people as doses.

For orders made by entities representing multiple economies like the European Union or the Carlos Slim Foundation, we assigned the agreement to every place within the group equally. Agreements in certain places like Brazil include those made by state governments.

We chose not to include the agreements made by Covax, the global, WHO-backed alliance for vaccine access, as nearly 200 countries have already joined the facility, making it a common starting point.

We expect this measure to change quickly and become more important for the Bloomberg Covid Resilience Ranking as vaccines start to be rolled out. We will adjust its makeup accordingly.

What does Lockdown Severity measure?

This indicator is based on an index produced by the University of Oxford, which assesses the number and strictness of government policies that limit people’s movements as a way of containing spiraling outbreaks.

We’re interpreting restrictive government policies as a negative in the Ranking as the stricter the lockdown, the more disruption people are experiencing. Taiwan is among the top-ranked for this indicator as the population is subject to almost no restrictions, while European countries, many of which just imposed stringent second lockdowns, rank lower. A higher score on Lockdown Severity denotes a less advantageous performance.

Some may argue that strict lockdowns should be viewed positively, a sign a government is acting aggressively to control the virus. But nearly a year, and multiple waves, into this pandemic, the need to impose lockdowns does reflect a failure to contain and manage Covid-19, and so we’re scoring it accordingly.

Stringent restrictions also correlate with the mental and economic toll of the virus on a population. Social disruption and isolation have been linked to higher suicide rates in some places, while school closures are raising concerns over child development and increases in hunger and drop-out rates among disadvantaged families. Melbourne, Australia’s second-largest city, lost 1,200 jobs a day during its three-month, second lockdown, a sign of the economic devastation that comes in tandem with stringent restrictions, particularly when they’re applied repeatedly.

Does Lockdown Severity reflect conditions across an entire economy?

The Oxford University index reflects the most stringent conditions in place in a given economy, regardless if those curbs are just being imposed in a specific region. That means a lockdown in one city or area will be the basis for an economy’s overall score.

This naturally penalizes large, expansive countries like China, India and even the U.S., where conditions can vary greatly from region to region and city to city. China scores relatively high on the Oxford index because some regions are under strict lockdown. Residents throughout most of the country -- including the mega-cities of Shanghai and Beijing -- face barely any restrictions, however, and more than 600 million domestic trips were taken during a weeklong national holiday in October.

Still, while imperfect, we view Oxford’s economy-wide approach as a proxy for how aggressively governments are likely to react if an outbreak emerges. China’s playbook this year has been to impose some of the most oppressive measures in the world, from bans on people in specific areas from leaving their homes to mass, obligatory testing. So while life is relatively relaxed for many in China right now, that could shift abruptly if even one case was identified where they live or work.

What does Community Mobility show?

Given the broadness of the Lockdown Severity indicator, and the fact it reflects government policy and not its impact, we sought out another datapoint to better capture this picture. Google’s Covid-19 Community Mobility Reports, which underpins our Community Mobility measure, tracks people’s real-time movements and helps round out our understanding of how they are responding to virus restrictions in their everyday lives.

We track movement to and from retail, recreational and work places, taking a 30-day average to smooth out the effects of holiday periods. The closer movement levels are to the economy’s pre-pandemic baseline, the higher the score on this datapoint as part of Bloomberg’s Ranking.

As Google data is not available for mainland China, we used an estimate from an activity tracker created by Bloomberg Economics -- used in a weekly analysis of activity in 26 major economies -- to derive China’s corresponding score. The correlation between Google’s data and Bloomberg’s daily activity tracker for the other 25 economies is high, giving us confidence in using it as a substitute for China.

Google doesn’t track mobility data for Iran, either, and we couldn’t find a viable alternative source, so Iran doesn’t score on this indicator.

What does the GDP measure track?

This indicator is based on the International Monetary Fund’s annual gross domestic product forecasts for 2020. The greater the expected contraction, the more challenging the economic reality is for people in these places, and therefore the weaker their performance on this measure.

China is an example of how eliminating the virus locally can lead to a rebound in economic activity. But its vast domestic market of more than 1 billion consumers means it’s an outlier. For almost every other place, containment and economic growth are in a complex trade-off relationship.

Places like Thailand, Singapore and New Zealand have nearly eradicated virus transmission among their populations, but at a massive cost to their economies, which are reliant on tourism and travelers from abroad.

Our GDP measure -- 2020 GDP Growth Forecast -- reflects the percentage contraction or expansion projected this year in the 53 economies. We chose to use this indicator, despite its bias towards emerging, high-growth economies, instead of the “swing” between the current forecast compared to the pre-pandemic forecast. This is because the Ranking aims to show the best places to be right now, not just how well they’ve deflected the economic blow from Covid-19.

The top scorers on the GDP indicator triumphed for various reasons. Egypt has an insular economy that is somewhat disconnected from the global supply chain, while Vietnam and Bangladesh’s low-cost manufacturing sectors have propped up growth in those places as the wider slowdown fueled Western consumers’ demand for cheaper goods. Developing economies that were growing faster than advanced ones prior to the pandemic, like Bangladesh, are still expected to grow modestly even when accounting for a coronavirus hit.

Why is the state of pre-pandemic health care relevant to Covid-19?

The Universal Healthcare Coverage indicator draws from a 2019 dataset published by the Institute for Health Metrics and Evaluation published in the Lancet in August. It maps the effectiveness of 23 preventive and treatment measures, ranging from access to basic non-Covid vaccines to cancer care.

While the dataset was produced prior to the onset of the pandemic, it reflects an economy’s ability to effectively prevent, detect and treat illness across a population. Bloomberg’s deduction is that places with higher scores on this measure are in a better position to prevent deterioration and death in Covid-19 patients, and more able to maintain the provision of non-Covid related health-care during the pandemic. Hong Kong isn’t tracked, so it doesn’t have a score for this indicator.

There are various measures and datapoints out there tracking the strength of health-care systems, including from the WHO. We chose this indicator due to its completeness: 204 countries and territories are tracked. It’s also the most up-to-date of those we surveyed.

What’s the point of including the Human Development Index?

This indicator, produced annually by the United Nations Development Programme, has three parts: life expectancy at birth, years of schooling, and wealth per capita. The three components were chosen to represent the overall well-being of a society.

Like the Universal Healthcare Coverage datapoint, this measure captures an economy’s pre-pandemic performance. Still, the Human Development Index reflects a society’s ability to withstand the Covid-19 blow, and can be a proxy for how populations have reacted to the crisis:

- Years of schooling reflects access to education and acts as a proxy for a population’s trust in science, which experts say is a key determinant in whether people follow public health guidance on social distancing and mask-wearing. We considered other measures of trust in science, such as the proportion of STEM degrees among degree-holders, but didn’t find a suitably comprehensive and up-to-date alternative dataset.

- Wealth per capita reflects people’s income, adjusted for purchasing power.

- Life expectancy is a proxy for whether access to health-care is equitable across a population.

The UNDP doesn’t include Taiwan in this indicator, but the government there calculates its own Human Development score every year using the same methodology. We use Taiwan’s self-published score for this measure.

Was the Ranking vetted?

The Covid Resilience Ranking is the result of months of sifting through various information sources by Bloomberg reporters and data specialists. It was developed in consultation with experts in the data collation, economic and scientific fields. While the Ranking is naturally a subjective measure, we think it captures fairly and comprehensively the best and worst places to live and work right now as we continue to ride out this pandemic.

It will morph and be updated as circumstances change -- stay tuned.

©2020 Bloomberg L.P.