Dec 12, 2023

Investors Are Unprepared for Stock Shocks, Wells Fargo Strategist Warns

, Bloomberg News

(Bloomberg) -- The stock market is getting ahead of itself on bets the Federal Reserve’s fiscal tightening is over, according to Wells Fargo’s Chris Harvey.

“Tomorrow, we expect Chairman Powell to continue to emphasize ‘higher for longer’ and to try to dissuade the markets of near-term easing,” the head of US equity strategy at Wells Fargo Securities said in a phone interview ahead of the central bank rate decision Wednesday. “However, we doubt market players will have a change of heart regarding the timing of upcoming rate cuts.”

US equities are due for a drop in the first half of 2024 as corporates’ pricing power fades and historical precedent suggests a rebound in volatility early next year, according to Harvey. He’s the latest Wall Street strategist to raise doubts that the stock market’s recent resilience can persist into next year.

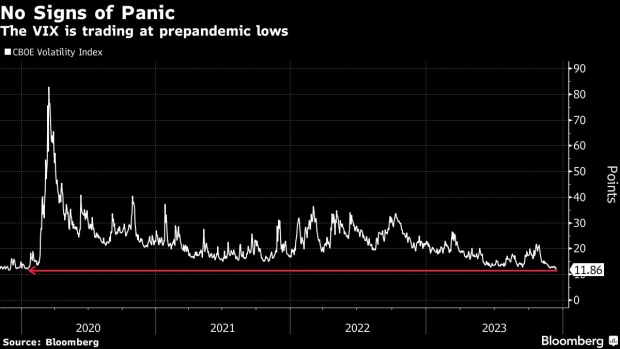

Wall Street’s fear gauge, the Cboe Volatility Index or VIX, has been subdued lately, trading below 13 and near prepandemic lows. “But while the VIX indicates smooth sailing, we see choppier markets ahead,” Harvey said.

Such a low level “indicates that the market is looking at the past” Harvey said. “There’s nothing that really scares it and there’s nothing that’s going to surprise it.”

But “history has told you the exact opposite,” he added. Looking back to 1998, when the year starts off with the Vix below 14, there’s a spike in volatility and a drawdown in equities in the first half.

Meanwhile, inflation data that mostly matched estimates did little to dent investor hopes for future interest rate cuts from the Fed on Tuesday as the S&P 500 hit a 21-month high. “There’s a fair amount of overconfidence and the market has gotten a little bit too optimistic on Fed easing,” Harvey said.

Read more: BofA’s Hartnett Says Bonds Rally May Drag on Stocks in Early ‘24

For now his team recommends investors stay the course in defensive bets, after his team upgraded the utilities and health-care sectors in late November.

Harvey expects the market to get more constructive in the second half of 2024 and eventually turn positive when the Fed finally starts cutting rates.

©2023 Bloomberg L.P.