Mar 10, 2022

Italian Bonds Lead Plunge in Europe as ECB Ramps Up Tightening

, Bloomberg News

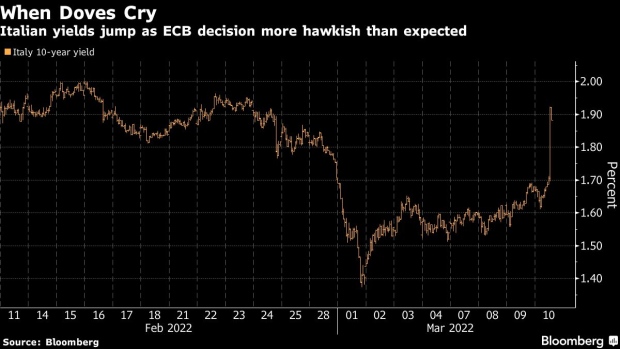

(Bloomberg) -- Italian bonds tumbled, leading a sell-off across the region’s bond markets after the European Central Bank unexpectedly brought forward plans to wind down extraordinary stimulus.

The yield on 10-year debt rose 21 basis points to 1.89%. That widened the yield differential with equivalent German debt -- a key gauge of risk in the region -- by 16 basis points to 162 basis points.

The ECB decided to slow its bond buying to 30 billion euros ($33 billion) in May, then to 20 billion euros in June, according to a statement Thursday.

“The last thing markets expected was for the ECB - which is usually very cautious around its wording - to come out with a definitive announcement of a faster taper to their QE program,” said Ima Sammani, an analyst at Monex Europe. “The uncertain outlook exposes the ECB to the risk of growth and inflation taking a U-turn mid this year.”

Officials are grappling with how to deal with the economic repercussions of Russia’s invasion of Ukraine, which threatens to curb growth and stoke inflation already running at a record pace in the euro-area. Consumer-price increases in the region accelerated to 5.8% in February.

Money markets brought forward bets for ECB hikes after the decision, and are now pricing a quarter-point hike in October from December before the decision. They see an additional move of the same amount in Feb. 2023.

Spanish 10-year yields rose 11 basis points to 1.25%, while equivalent Greek rates were up 13 basis points at 2.52%. ECB President Christine Lagarde will hold a news conference at 2:30 p.m. in Frankfurt.

The news also sent Italian stocks tumbling, with the FTSE MIB index down 4.1%, led lower by banking stocks. UniCredit SpA slipped 7.4% while Intesa Sanpaolo SpA sank 6.4% and BPER Banca dropped 6.3%.

“Overall, this is a net negative for the periphery and it is not surprising that BTPs and Spanish yields are rising sharply after the ECB statement,” said Sandrine Perret, senior economist and fixed income strategist at Vontobel Asset Management.

(Updates prices, adds analyst quote in fourth paragraph.)

©2022 Bloomberg L.P.