Sep 14, 2023

Italy Banks Drop as Meloni Rules Out Capping Windfall Tax Inflow

, Bloomberg News

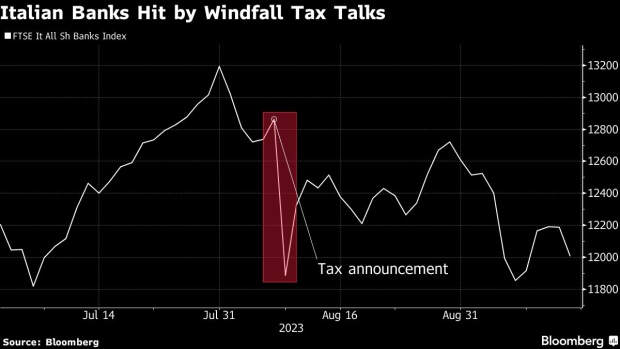

(Bloomberg) -- Shares in Italian lenders fell on Thursday, making them the worst performers on the STOXX Europe 600 Banks index, after Prime Minister Giorgia Meloni said that even if a new windfall tax on banks’ profits is modified, the state will still expect inflows of almost €3 billion ($3.2 billion).

Meloni’s comments on Wednesday “should revert the market’s concerns on Italian banks in our view today, triggering a negative share price reaction,” analysts at Mediobanca SpA wrote in a Thursday note.

BPER Banca SpA dropped as much as 3.4% while Intesa Sanpaolo SpA fell 2.1% as of 10:04 a.m. in Milan, making it the worst performer on the benchmark index. Banco BPM SpA, Banca Monte dei Paschi di Siena SpA and UniCredit SpA also declined.

The Italian government imposed the levy on additional profits earned by banks aftter accusing the industry of being too slow to pass benefits from higher interest rates on to clients. The tax applies to 40% of banks’ extra profits, as defined against a 2021 benchmark, and won’t exceed 0.1% of a firm’s assets. Intesa and UniCredit, the two biggest lender in the country, face the steepest costs from the new levy.

--With assistance from Macarena Muñoz.

©2023 Bloomberg L.P.