Jan 17, 2024

JPMorgan Sees Hacking Attempts on Systems Double to 45 Billion Per Day

, Bloomberg News

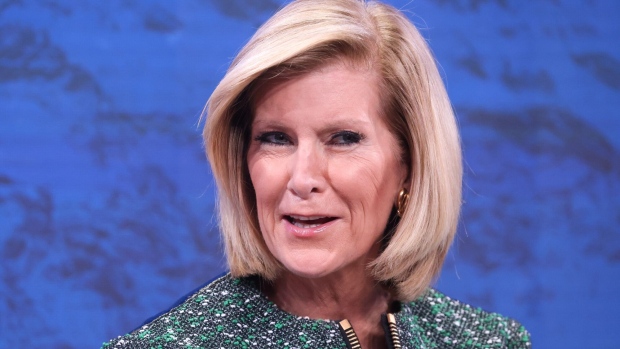

(Bloomberg) -- JPMorgan Chase & Co. has seen an increase in hackers attempting to infiltrate its systems as the Wall Street giant and its rivals continue to deal with a surge in global cybercrime, according to Mary Callahan Erdoes, who leads JPMorgan’s asset and wealth management division.

“The fraudsters get smarter, savvier, quicker, more devious, more mischievous,” Erdoes said in a panel at the World Economic Forum in Davos. “It’s so hard and it’s going to become increasingly harder and that’s why staying one step ahead of it is really the job of each and everyone of us.”

After the panel, JPMorgan clarified Erdoes’s comments on the number of hackers attempting to infiltrate its systems every day.

“Ms. Erdoes was referring to observed activity collected from our technology assets, malicious or not. This activity is then processed by our monitoring infrastructure,” Joseph Evangelisti, a spokesman for JPMorgan, said in a statement. “Examples of activity can include user log ins like employee virtual desktops, and scanning activity, which are often highly automated and not targeted.”

With geopolitical tensions rising globally in the aftermath of Russia’s invasion of Ukraine almost two years ago, banks have been dealing with a surge in cyber incidents. More than 70% of bank leaders in a 2023 survey by KPMG said cyber crime and cyber insecurity was a pressing concern for their organization.

JPMorgan now spends about $15 billion on technology every year as part of its attempts to bolster its cyber defenses, Erdoes said. That figure has been on the rise in recent years: JPMorgan previously said it spent about $14.3 billion on technology in 2022.

Erdoes also said the company has nearly 62,000 technologists who are also helping to secure its systems.

(Removes number in headline and first paragraph after company corrects to clarify Erdoes was referring to all activity on JPMorgan’s systems, malicious or not.)

©2024 Bloomberg L.P.