Jul 11, 2022

Kishida’s Win Creates Space to Pursue ‘New Capitalism’ for Japan

, Bloomberg News

(Bloomberg) -- Japanese Prime Minister Fumio Kishida’s strong election victory presents him with a three-year time frame to pursue his own agenda of making capitalism fairer and greener, with no need to quickly change course on economic policy including central bank stimulus.

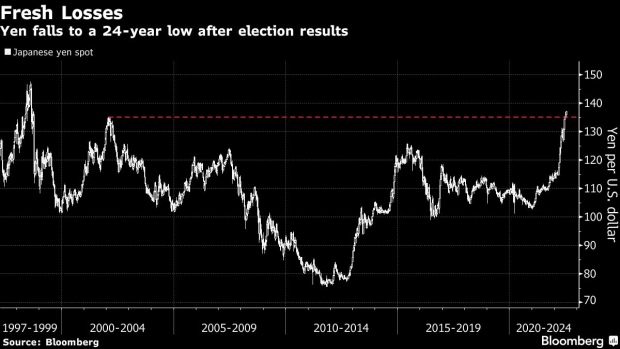

That view was largely backed up by market moves on Monday, with the yen falling to a fresh 24-year low against the dollar as investors appeared to conclude that the easing stance of Bank of Japan Governor Haruhiko Kuroda is set to continue for now.

The next key gauge of whether Kishida intends to move away from policy settings largely based on those of murdered former Prime Minister Shinzo Abe will come when the premier unveils a new aid package to relieve the pain of soaring food and energy prices. That could come as soon as next month.

Legacy of Abenomics to Live Beyond Its Tragically Shot Architect

“The election outcome reflects public support for Prime Minister Fumio Kishida, and makes it clear that rising inflation in Japan isn’t as critical for the public as overseas,” said Juntaro Morimoto, analyst at Sony Financial Group Inc. “It may make it easier for him to maintain current easy monetary policy during Kuroda’s term, a view that lends to yen selling on receding expectations for a policy tweak.”

The scale of the aid measures will indicate how committed Kishida is to sticking with Abenomics or forging his own path. For now economists and strategists expect that any changes would come at a slow pace, with Kuroda seeing out his term with the current monetary policy framework largely in place and no rush on deciding his replacement.

A smaller, targeted spending package will revive the impression that Kishida is more cautious on spending than Abe and former premier Yoshihide Suga. Another big package will show Kishida is likely intending to follow closely in the footsteps of Abenomics.

“I don’t expect a big spending round to deal with the current inflation even though some ruling party members are calling for it. Kishida will probably stick with his approach of putting a band-aid where inflation hits hard,” said Atsushi Takeda, chief economist at Itochu Research Institute. “Kishida is likely to gradually shift toward restoring fiscal health with the election victory to reflect his own views.”

An announcement may come as Kishida reshuffles his cabinet, according to analysts.

The government’s existing price relief measures already include fuel subsidies that are reducing gasoline prices by around 20%. Through these steps, the government has essentially enabled the BOJ to continue with rock-bottom interest rate settings that are contributing to yen weakness by easing some of the pain it causes.

The yen was at 136.95 against the dollar at lunchtime in Tokyo having reached 137.28 earlier in the day. It has sunk over 16% against the greenback this year.

Any changes for monetary policy would likely come after the government has had time to see the new package implemented and digest developments in markets, economists said. While political pressure for change has eased for now, market pressure could resume, with another two large interest rate hikes expected from the Federal Reserve this quarter.

The Big Japan Short Is Back for Hedge Funds Betting Against BOJ

It’s risky to change monetary policy when the economy has yet to recover to its pre-pandemic levels and global economies are facing the growing risks of a recession, according to Goldman Sachs Japan’s chief economist Naohiko Baba and his colleague Yuriko Tanaka.

Kishida has called for a fairer distribution of incomes as a way of making economic growth more sustainable, but his call for higher wage hikes has yet to trigger a major shift in pay gains. His vision of “New Capitalism” still requires fleshing out in more detail but will include more measures to help the economy become greener and reach its emissions goals.

BOJ’s Rock-Bottom Rates Are Crucial for Kishida’s Spending Plans

Investors are more closely watching to see if the premier intends to change the shape of monetary policy. Kishida will pick a new BOJ governor and two deputies when their tenures end in less than a year.

Like Abe orchestrated a policy accord in 2013 with former BOJ governor Masaaki Shirakawa, Kishida may first overhaul a joint policy statement with the central bank before Kuroda leaves office in April, said Hideo Kumano, executive economist at Dai-Ichi Life Research Institute.

“I’m not sure if they will change the 2% inflation target, but Kishida can show his own clout by giving more flexibility on the target rather than absolutely defending it,” Kumano said. “If that happens, you can then say Abenomics has switched to Kishidanomics.”

©2022 Bloomberg L.P.