Jun 10, 2019

Larry Berman: Are markets or Trump's tariffs driving Fed policy?

By Larry Berman

Larry Berman: Who's driving Fed policy?

You no doubt have heard in recent weeks that the U.S. Federal Reserve has shifted its bias from raising rates to cutting rates—perhaps aggressively, and as early as next week. How fragile is the global economy if the Fed needs to consider cutting rates while the economy is at full employment of 3.6 per cent? I think extremely fragile and massively leveraged. Low rates are likely here for a long time and it will have implications for your portfolios.

It was only a few months ago (the March dot plots) the Fed was telling us that rates would be going up and now the market has priced in almost three rate cuts in 2019. Does global trade mater that much to world GDP and the markets? You bet! The foreign exchange markets provide some insight. To economies that rely more on trade for growth (like Germany and Japan…and formerly China) the foreign exchange rates matter a lot.

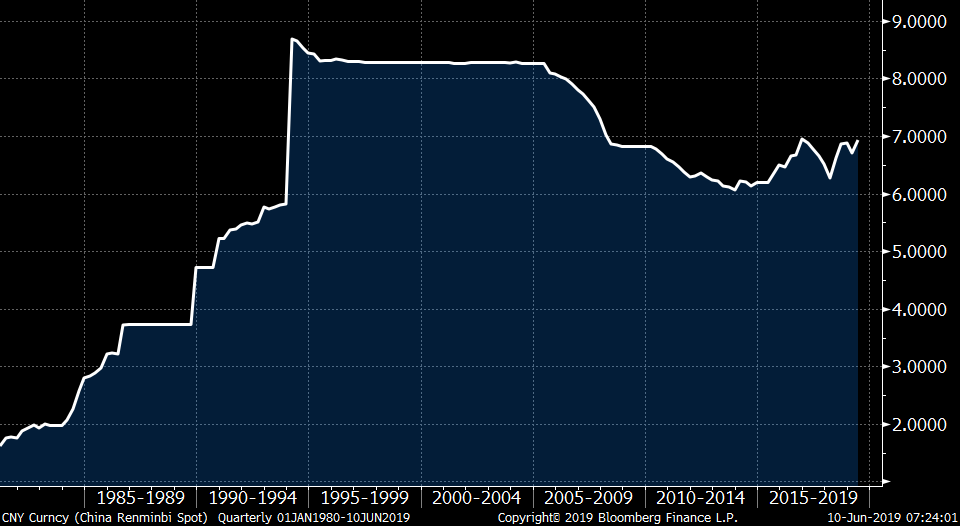

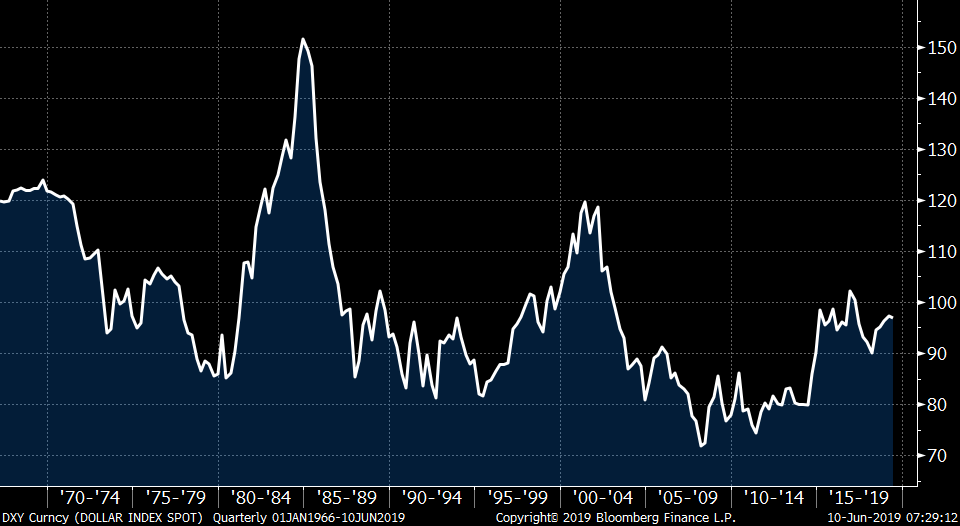

As trade matters go, currency exchange rates are a major factor. There is talk in the market that in order to complete a trade deal with China (and potentially get re-elected), Trump needs a weaker U.S. dollar. Hence his recent pressure on the Federal Reserve to cut rates. A weaker U.S. dollar against the Chinese yuan allows China to weaken its currency to offset the economic impact of U.S. tariffs. And, as you may have heard many times from myself and others, the vast majority of tariffs are absorbed by U.S. consumers. It’s the foreign exchange markets that would need to adjust so that overall price increases are mitigated.

Here is the math

Let’s say a Chinese good costs US$40 to the American company importing it. Tariffs are added at 25 per cent, and now that item costs US$50 to import. The Chinese exchange rate to the U.S. dollar is about 7 yuan per. So, in Chinese currency terms, the product costs 280 yuan before tariffs. The Chinese merchant does not have to pay any more at all to sell the product, all the cost is born by the importer (paid to the U.S. Treasury). Now assuming the same product can be manufactured in the U.S. or some other market for less than US$50 (the new cost after tariffs), the importer could source the product elsewhere or pass the cost to clients or eat some in terms of lower profits (likely some combination of the above). In any event, the price has gone up.

Now, if the foreign exchange of the Chinese currency changes to 8.75 yuan per 1 U.S. dollar (a 25 per cent decline), than the cost to the U.S. importer is now US$32 plus the 25 per cent tariff or a total of US$40 (the same as it was before tariffs), while the Chinese merchant still gets their 280 yuan. A stronger U.S. dollar is generally bad for earnings of U.S. companies where a significant portion of their sales (about half) comes from foreign sources. It also stresses global markets that are leveraged to U.S. lending.

Perhaps it’s no coincidence that the weakest level ever for the Chinese currency (and arguably where Trump started buying Chinese steel to build with) was in the ‘80s and ‘90s, when they rapidly depreciated their currency to compete with the world on trade.

Trump wants the Fed to cut rates so the U.S. dollar weakens, because his plan may be to go after Germany and Japan on auto tariffs if a deal with China can get done. We expect China to play hardball and push a trade deal into 2020 o stress Trump for a better deal going into his re-election campaign. You had better believe these are strategic geopolitical decisions as much as they are economic ones. Expect these trade wars to add much more market volatility heading into 2020 as long as Trump insists on using tariffs has his weapon of choice. The recent negotiation with Mexico has shown that he will continue to use it to get what he wants.

I see the December equity market lows breaking before we can see sustainable new highs in equity markets. The fact that the Fed has to cut rates should remind you how fragile the world markets are instead of being a bullish reason to buy equities. The weakening economic data and hopes for rate cuts to save the day are likely misplaced.