Dec 12, 2022

Larry Berman: FOMC likely to pound fist on higher for longer

By Larry Berman

Larry Berman's Educational Segment

The market likely got the wrong message from Chairman Powell after the Nov. 30 speech and interview. The Federal Open Market Committee (FOMC) first started to socialize the higher for longer message at the Sept. 21 FOMC meeting. All will know the FOMC has been way behind the curve in terms of inflation expectations, but they have caught up rapidly. In recent months, the market has started to aggressively price in a recession in 2023. The last time the yield curve was this inverted was during the “Volkerization” of inflation in the early 1980's.

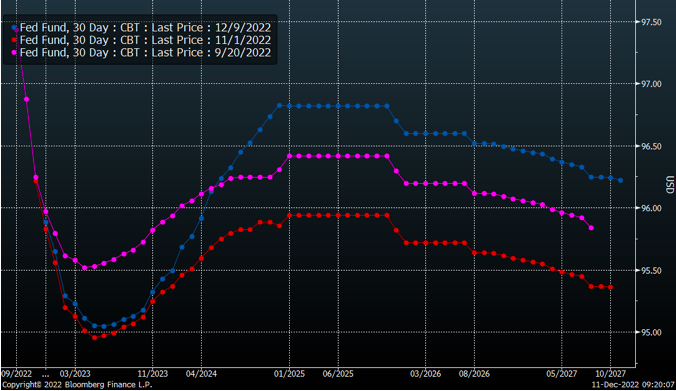

Our first chart shows the Fed funds futures curve (pink line) on the day prior to the Sept. 21 FOMC meeting. At this meeting, they raised expectations for a higher terminal rate than the market was expecting. Recall that Powell overtly spoke out to weaken asset prices at the Jackson Hole conference in late August. We have seen several attempts by the market to price in a FOMC pause or pivot, but each time Powell has crushed that expectation with the exceptions of the Nov. 30 update at the Brookings Institute, and markets were caught a bit short rallying very strong in the last few hours to close the month. All will know now; those gains have been entirely reversed.

The higher for longer narrative had correctly pushed the curve out by the Nov. 2 FOMC (red line). The entire forward curve shifted higher, with a terminal rate ranging between four to five per cent for the next five years. The lower the level the higher the interest rate. Fed fund futures are priced based on the expected average yield at the time the futures contract expires. A 95 price suggests a five per cent yield (100-95= five). We can see from the September meeting until this week (blue line), the terminal (highest expected) rate has moved to about five per cent. The rate five years from now is expected to be around 3.75 per cent.

For me, the debate this week is not about 50 bps or even the slower pace to two more 25 basis point hikes in the first-quarter. It's how they recognize the obvious recession the market believes is coming while the FOMC keeps the flame alive for a soft landing. Something here does not reconcile and that often means some volatility in markets still needs to be debated.

The equity markets are not priced for a flat yield curve for the next five years. This speaks to the difficulty the market sees ahead about easing policy. In September, the rate at the end of 2024 was expected to be about 3.50 per cent and by the November meeting a little over four per cent. But with the economic data since that meeting, the market is pricing in rate cuts over the next two years down to about 3.25 per cent. In other words, that the FOMC will need to ease likely due to a recession.

From an equity standpoint, we have identified the days of the past four FOMC meetings and the 3,800 area for the S&P 500 is where equities were at three of them. If the market moves below 3,800 again, it would be more correctly interpreting the recession risk the Fed funds futures see while staying above it suggests more of a Goldilocks soft landing scenario. Santa may be able to hold the seasonal yuletide for a while longer, but if companies downgrade their earnings outlooks as we expect (in January), we can expect more volatility ahead.

Historically, markets do not bottom until the FOMC cuts rates a few times. This would argue more volatility ahead versus an all clear. Those looking for a bottom and a new liquidity inspired bull market should consider many of these factors that most have not seen in their investing lifetimes.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com