Feb 10, 2020

Larry Berman: Is activist ESG investing causing market mispricing?

By Larry Berman

Is activist ESG investing causing market mispricing?

Activist investing often sees large pools of money being paid for major stakes in companies, with buyers seeking representation on boards and to effect change in the C-Suite. A new type of activist investing is gaining momentum in the world of exchange-traded funds: Environmental, social and corporate governance (ESG). Companies today are ranked on the degree to which they are good corporate citizens by, for example, mandating pay equity, minimizing their environment impact or ensuring diversity in management.

Our upcoming roadshow is focused on using ETFs to take a more active approach to investing. Active can mean “activist” in terms of voting with how you invest your dollars by way of ESG-type investing. Active can also mean knowing when to make a bigger bet in one sector or one part of the world versus taking a more passive, market-capitalization approach. Another approach is factor-type investing, which selects stocks based on “the best” fundamental characteristics. Most BNN Bloomberg viewers are more familiar with ETFs as passive-investment vehicles that simply track an index like the S&P 500 or S&P TSX. ETFs are being blamed by “active” investors (stock pickers) for causing all sorts of mispricing. Because when you buy the index, you buy all the companies in the index regardless of their fundamentals. While this is true, the reality is that about 85 per cent of investors that do select individual securities do not beat the index, after fees, in the long-run.

So in the world of ESG-themed investing, some great companies are being mispriced (for us, that means opportunity), and that is raising the interest of some long-time value investors.

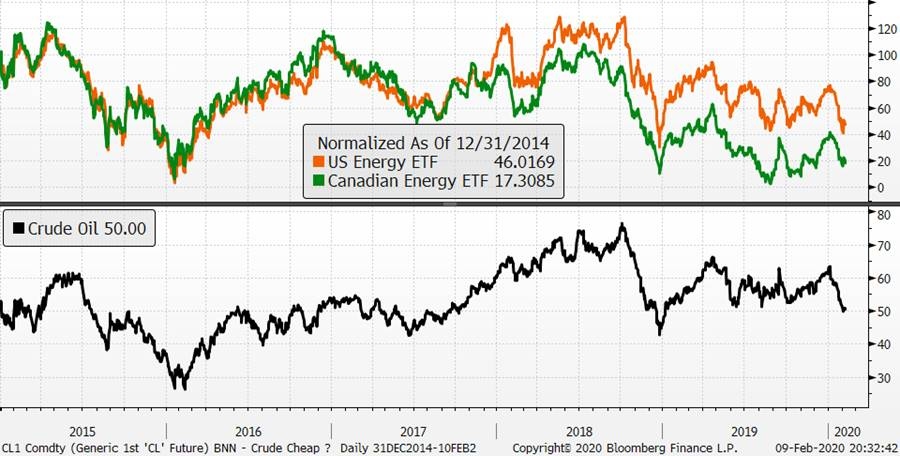

Well-known value investors like Sam Zell and Warren Buffett are rumoured to be looking at the beaten-up energy sector for bargains. I take a value approach (or a growth approach, at a reasonable price) to markets, so charts like this capture my interest.

Going back to 2015 when WTI first crossed back below US$50 (from US$100+ in 2014), the total return of the ETFs representing the energy sector have performed poorly and are priced today for WTI being closer to US$30. The top part of the graphic is a percentage return (including dividends). The Canadian energy sector is trading at about 20 per cent of the value it was at about five years ago when WTI first fell through US$50. In the U.S., the sector is about 40 per cent of the value. The main difference between the U.S. and Canada, when it comes to the energy sector, is that the pure exploration-and-production companies in the latter have been hit much harder.

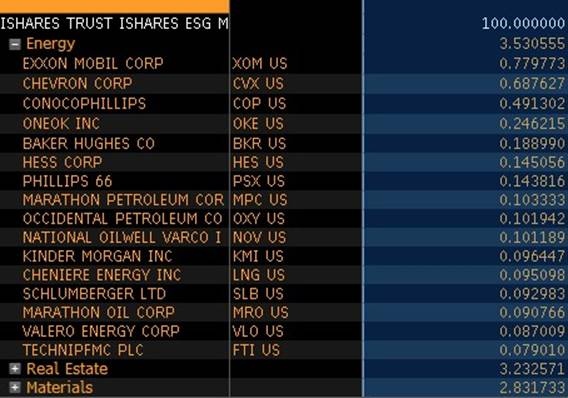

The biggest U.S.-listed, ESG-weighted ETF is the iShares Trust iShares ESG MSCI USA ETF (ESGU), which holds about U$3.6 billion in total assets. The energy-sector weight is not zero, as one might imagine. While it is lower than in market-cap weighted indexes like the S&P 500, some of the biggest holdings are energy companies like Exxon Mobil Corp. (XOM) and Chevron Corp. (CVX). Some may be surprised to see some of these names in an ESG index, but some of these companies are amongst the biggest investors in clean-energy sources. The truth is that the energy sector has taken a hard hit from ESG-themed investing, and many companies are having to adapt.

Companies with higher ESG rankings are likely to be amongst the biggest winners from this trend.

BMO recently launched a Global ESG Leaders ETF (ESGG), which includes a few Canadian energy stocks like Enbridge Inc. (ENB) and Suncor Energy Inc. (SU).

ESG investing is likely going to be a major consideration for many institutional investors moving forward, but it is something that also appeals to millennials. I asked my 22-year-old daughter if she would prefer to invest her money in ESG-themed companies even if that meant slightly-lower potential returns, and the answer was a resounding “yes.”

During these early days of ESG investing, we are biased in favour of owning companies in the space with better ESG footprints.

Our upcoming spring roadshow will focus on how to include more active-based ETFs in your portfolio. From ESG and defined outcome to alternative (long/short), each more-active style has its place. Millennials may prefer to tilt their portfolios towards more environmentally-friendly products, whereas more risk-adverse investors may like defined outcomes while those who more adventurous may seek to make money in adverse conditions with alternatives. Come out to see how these new and growing areas of ETFs can be included in your portfolios. As always, we ask for a voluntary donation in support of dementia and Alzheimer’s research at the Baycrest Hospital to attend. We have raised more than $500,000 in the past decade thanks in part to BNN Bloomberg viewers and a matching donation from yours truly.

| Halifax | March 18, 2020 |

|---|---|

| Montreal | March 19, 2020 |

| Ottawa | March 21, 2020 |

| Saskatoon | March 24, 2020 |

| Winnipeg | March 25, 2020 |

| Toronto | April 5, 2020 |

| London | April 14, 2020 |

| Waterloo | April 15, 2020 |

| Newmarket | April 19, 2020 |

| Edmonton | April 22, 2020 |

| Calgary | April 25, 2020 |

| Kelowna | May 5, 2020 |

| Victoria | May 6, 2020 |

| Vancouver | May 9, 2020 |

Twitter: @LarryBermanETF

LinkedIn: ETF Capital Management

Facebook: ETF Capital Management

Website: www.etfcm.com