Apr 10, 2024

March Inflation Data to Prolong Drama Around Fed Rate-Cut Timing

, Bloomberg News

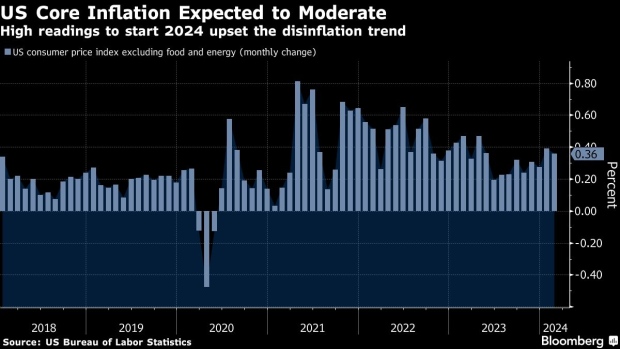

(Bloomberg) -- A monthly report on consumer prices due Wednesday is unlikely to settle the debate around the timing of Federal Reserve interest-rate cuts, with forecasters expecting some moderation following elevated inflation readings at the start of the year.

The consumer-price index excluding food and energy, a key gauge of underlying inflation, probably rose 0.3% last month from February, according to the median estimate in a Bloomberg survey of economists. While that would mark a step down versus the previous two months, it may not be enough to quell concerns among central bank officials looking for even lower readings.

Analysts generally expect the March CPI data to show measures of rental inflation — the largest components of the index — to resume a downward trend after an unexpected acceleration to begin the year. Other key categories, like used cars on the goods side and airfares on the services side, could have an important impact on the overall numbers.

What Bloomberg Economics Says...

“The March CPI report likely will show that the hot CPI readings of the previous two months were an aberration, not the start of an alarming trend. That would affirm the view expressed by Fed Chair Jerome Powell and several other FOMC officials that disinflation is likely an ongoing trend, and it’s still appropriate to consider cutting rates around mid-year.”

— Anna Wong and Stuart Paul, economists

To read the full note, click here

Ahead of the release, investors are putting roughly even odds on June as the likely starting point for rate cuts, according to futures. Here are a few key components to watch in the CPI report:

Rents

Owners’ equivalent rent and rent of primary residence are the two largest components of the CPI, and therefore among the most closely watched. An unexpected acceleration in January disrupted what had been a relatively steady downward trend over the course of 2023, and a subsequent moderation in February wasn’t big enough to bring a weighted average of the two components below its December pace.

Read More: How a Key Rent Metric Can Change Path of US Inflation

Rental inflation in the CPI is widely expected to continue moderating throughout 2024 based on trends in leading indicators, such as private-sector measures of rents on new leases, though the exact timing is harder to pin down from month to month.

Used Cars

Outright declines in goods prices contributed to rapid disinflation in the overall CPI in the second half of 2023, and used-car prices have typically been among the biggest swing factors for the so-called “core” goods basket in recent months after surging 54% between February 2020 and February 2022. In January, they dropped 3.4%, but in February, they rose 0.5%.

“We expect both used (-0.5%) and new (-0.3%) car prices to decline in March, reflecting lower used-car auction prices and rising promotional dealer incentives,” Goldman Sachs economists Manuel Abecasis and Spencer Hill said in an April 8 report previewing the numbers. “Looking ahead, we expect used and new car prices to decline by 8.2% and 1.4% respectively this year, reflecting normalizing auto production, higher inventories, and higher new vehicle incentives.”

Airfares

While declines in core goods prices have been a major driver of overall disinflation, many Fed officials have been acutely focused on prices of core services excluding rents because they see those as more reflective of broader economic trends. Volatile airline fares helped boost such core services prices in January and February, with the biggest two-month increase since mid-2022.

Bank of America economists Stephen Juneau and Michael Gapen said they anticipate a moderation in Wednesday’s report.

“Declines in travel related categories like airfares and lodging away from home is a key factor behind our expectations for this aggregate to cool off in March,” they said in an April 4 report previewing the data.

©2024 Bloomberg L.P.